| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

|

SEASONALITY: THE FIRST NINE TRADING DAYS OF AUGUST ARE HISTORICALLY WEAK

See 07/30 Market Recap for more details.

INTERMEDIATE-TERM: HINDENBURG OMEN MEANS A CRASH AHEAD?

My guess is you’ll see so called Hindenburg Omen all over the newsletters or blogs or even medias, as many bears have been waiting for it for a long long time, because it’s said whenever it appears the market would soon crash. Personally, I’m not sure about this stuff, but since it’s triggered today and famous, better be careful than sorry.

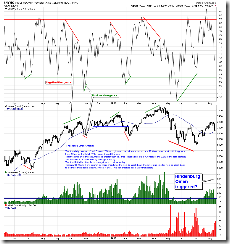

The chart below shows the Hindenburg Omen in year 2007 and 2008. I think you should all remember what happened thereafter.

Whenever there’s a Hindenburg Omen there is T2105, too many new highs and new lows at the same time means an internal inconsistency in the market therefore is not a good sign.

So to summarize above, looks like the intermediate-term is not good, well, signal wise, but bulls can always say, “Yes We Can!” or “Never Fight with Fed”, so frankly, I’m not sure. Just as usual, I simply told you what I see.

SHORT-TERM: MARKET COULD HAVE BOTTOMED, NEED FOLLOW THROUGH TOMORROW

I see reversal bars all over the place. See chart below for a few examples. The chart 6.3.2c Major Distribution Day Watch illustrated in the yesterday’s Market Recap actually shows some cases that a tradable bottom was formed the next day after NYDNV to NYUPV ratio > 35, so I cannot deny the possibility that the market was bottomed today as long as there’s a follow through tomorrow.

The long position for SPY ST Model entered on 07/20, should be stopped out today losing significant portion of its profit. I think I’ve reminded the partial profit taken in the 08/09 After Bell Quick Summary, and explained it’s the price sometimes we have to pay for chasing maximum profits by holding as long as possible. As mentioned in the table above, if a green day tomorrow, SPY ST Model will have a long signal. What I wanted to say is, if indeed a long is confirmed by SPY ST Model, since it has 81% winning rate, so in some senses it also can prove that the market has bottomed. Well, again SPY ST Model is for fun only, YMYD.

So to summarize above, whether the market could close in green tomorrow is very important. The question is, could the market close in green?

I only know 2 things:

Seasonality wise tomorrow is the most bullish day in August and the seasonality is mostly bull friendly thereafter.

As mentioned in the 08/06 After Bell Quick Summary, back to back unfilled gaps will be filled very soon and indeed. See chart below, if a gap down tomorrow, it’s guaranteed to be filled because it’ll be again another back to back unfilled gaps (well, sort of, not strictly).

So to summarize above, at least tomorrow bulls have a little bit better chances.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

| TREND | COMMENT – *New update. Click BLUE to see chart if link is not provided. | |

| QQQQ | UP | |

| IWM | UP | 4.1.2 Russell 2000 iShares (IWM Weekly): 2 black bars in a row, doesn’t look good. |

| CHINA | UP | |

| EMERGING | UP | |

| EUROPEAN | UP | |

| CANADA | UP | |

| BOND | UP | |

| EURO | UP | |

| GOLD | *UP | |

| GDX | DOWN | |

| OIL | UP | |

| ENERGY | UP | |

| FINANCIALS | UP | |

| REITS | UP | 4.4.3 Real Estate iShares (IYR Weekly): Home builder is lagging, be careful. |

| MATERIALS | UP |