SHORT-TERM: REBOUND, IF ANY, IS SELL

Two conclusions:

- Could see a rebound as early as tomorrow.

- Rebound, if any, is sell.

Listed below are the reasons why we could see a rebound as early as tomorrow:

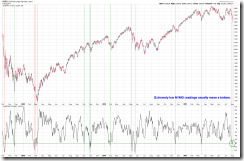

- NYMO oversold. This is not an ordinary oversold, it’s extremely oversold.

- 2 Major Distribution Day within 5 days means rebound but also means rebound, if any, is sell.

- Today’s SPX bar looks like an exhaustion bar, so a rebound of some kind should be close. It doesn’t guarantee green tomorrow or even worse, could be another bigger red bar with even bigger volume (which means more exhaustion), so I don’t mean it’s the reason for a rebound tomorrow, it just means that we’re almost there, it’s a sign when I read charts, that’s it.

Why, rebound, if any, is sell?

- Still it’s the law of inertia, a forward accelerating car cannot be reversed without slowing down first. NYMO new low means the downward is accelerating so need a sign of decelerating first which in terms of NYMO is NYMO positive divergence that is still missing in the chart below.

- As mentioned above 2 Major Distribution Day within 5 days, although could mean a short-term rebound but it’s not pleasant on a little bit longer than short-term.

- Remember all the reasons I blah blah in 08/01 Market Outlook? They’re mostly still valid, especially that SPX down 5 days or more stuff, since no rebound today, so it should be valid for sure.

INTERMEDIATE-TERM: IN DOWNTREND, SPX TARGET MARCH LOWS AT 1249

See 08/01 Market Outlook for more details.

SEASONALITY: BEARISH FIRST 9 TRADING DAYS OF AUGUST

See 07/29 Market Outlook for more details. Also please see 07/29 Market Outlook for day to day August seasonality chart.

ACTIVE BULLISH OUTLOOKS:

07/01 Market Outlook: Bullish July. Also one more evidence in07/05 Market Outlook.Failed!07/07 Market Outlook: New NYHGH high means SPX higher high ahead.Failed!

ACTIVE BEARISH OUTLOOKS:

07/20 Market Outlook: Multiple evidences arguing for more pullbacks ahead. Also 2 more evidences in07/25 Market Outlook.07/22 Market Outlook: Bearish on AAPL, therefore QQQ as well.- 08/01 Market Outlook: Rebound, if any, is sell. Also so 08/02 Market Outlook for more evidences.

SUMMARY OF SIGNALS FOR MY PUBLIC CHART LIST:

| |||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||

|