Breakout Friday, good, three points to say:

1. Intermediate-term still up.

2. Short-term very very overbought, should pullback sometimes next week.

3. Financial sector still lags.

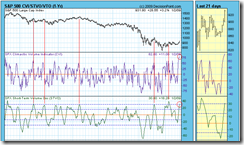

0.0.2 SPY Short-term Trading Signals, clear breakout just too many overbought signals, although according to TICK (see dashed red lines), still Monday could be up again.

1.0.3 S&P 500 SPDRs (SPY 30 min), overbought, surprisingly no negative divergence yet, so again Monday could be up.

1.3.7 Russell 3000 Dominant Price-Volume Relationships, 1433 stocks price up volume down, bearish, this also means a pullback could occur no later than Tuesday.

SPX CVI and STVO from www.decisionpoint.com, overbought.

T2122, 4 weeks New High/Low Ratio from Telechart, overbought.

5.0.1 Select Sector SPDRs, apparently the Financial sector is the weakest of all while the defensive sectors, XLV and XLP are leading, not good. By the way, XLY leads because Retailers are good but Home Builders are still weak.

0 comments:

Post a Comment