The setup of technical indicators is very similar with Jan 14th, where TICK closed below -1000, so tomorrow the market may reverse during the day just like Jan 15th. In this report we will review several important bottom fish signals and see how far the market is from the possible bottom. Again, bottom fishing is very risky even all bottom fish signals are pointing the bottom.

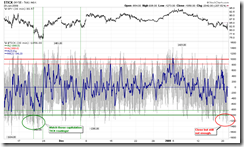

0.0.2 SPY Short-term Trading Signals. Note what the green dashed lines are pointing to, if TICK closes below -1000, the market should sell off further in the next day but the probability of intraday reversal is very high. The worst situation happened on Nov 19th, and the market sold off on the next day and didn't reverse until the very end of trading hours in 21st.

1.0.3 S&P 500 SPDRs (SPY 30 min). Oversold, and the market may bounce back up at least in the tomorrow morning.

1.0.4 S&P 500 SPDRs (SPY 15 min). Again oversold, and the market may recover in the morning.

1.0.5 Major Accumulation/Distribution Days. Today is the second major distribution day. According to the past record, there will be some decent rebound after two major distribution days, or the third major distribution day. The possible rebound is of course not confirmed yet, but it's still better than having just one major distribution day.

1.3.7 Russell 3000 Dominant Price-Volume Relationships. 1631 stocks price down volume up, which means the market is oversold. You may check the green comments and see what happens in the next day after the similar price down volume up setup.

2.0.0 Volatility Index (Daily). Today VIX broke ENV 20 which is quite extreme.

As a summary, should the technical analysis still works the market may bounce back up tomorrow (in recent several months the market often goes extremely. Before it gets very extreme, it's hard to say if these conventional TA signals still work or not although they used to work very well in the past)

OK, now let's review three bottom fish signals and see where they are, and how many days the market could still drop down in the most possible worst scenario.

2.4.2 NYSE - Issues Advancing. Famous NYADV is not yet oversold. It may take two more days to reach the oversold region. At the worst scenario it may stay at oversold for three days. So we might see five down days afterward if the market gets very very extreme.

T2122 from the Telechart, 4 weeks New High/Low ratio, not oversold yet. If it is oversold, it may stay there for a while.

7.0.7 NYSE - TICK (30 min). See those capitulation of TICK readings under -1000 in last November, compare with the current reading -- again, not yet.

I love your comments and your systems. Good work.

ReplyDeleteThe issue with bottom calling at this point is that we might be up against an historically unprecendented event.

It really might be different this time. (at least for the next few days/weeks)

Hi, JH, I wonder how you know that this time is different? Would you mind explaining more? Thanks.

ReplyDeleteCobra,

ReplyDeleteI wasn't trying to express anything profound, or even challenge the material you present in any way.

It just seems like this environment is very hard to read with "standard" tools, so "bottom calling" seems to get trickier.

Does that make sense?

jh

Hi, Jh, got you thanks. Sorry about My English, if it sounds a little offending. I really wanted to know everybody's thoughts. When you get to know me well, you'll know I'm very open minded and I admit my mistakes very quickly. Thanks again JH. Keep in touch.

ReplyDeleteCobra,

ReplyDeleteOkay . . . thanks for clarifying.

It just seems like everything has changed . .

. . . like the expectations for business should be fundamentally rethought because we've reached an inflection point where the typical remedy (i.e., more national debt) can't help us (i.e., the US)

that's what I mean by looking for a bottom . . . that the typical measures might not work . . . at least for a while

Jason at sentimentrader tracks mutual fund inflows and outflows. during the bullish period, outflows were a time to buy. since the market has turned down, net inflows are a time to sell.

this type of inversion in expectations is what I'm talking about

I hear people on CNBC looking for the next bull market, and talking about stocks that will weather the storm (of course, they're just promoting the stocks they own).

But I'm realizing that the real opportunities might lie outside of the stock market (e.g., gold).

Just some random thoughts, backed up by scant evidence

thanks

jh