Today's pullback was far more than I've expected, so the worst case, long expected sell off in chart 2.8.2 SPX:CPCE might have started. Tomorrow, the market might bounce back at least in the morning. However, since there're so many "top (at least short-term)" signals, although I'm not sure if the market can still go up a lot, it looks like bears have nothing to worry about at the current stage (at least a chance to escape without being punished). On the other hand, any bounce is a gift for bulls.

7.0.3 NYSE Composite Index Breadth Watch, this is how I measure the market.

Evidences for a possible bounce tomorrow (Not very strong evidences though):

1.0.3 S&P 500 SPDRs (SPY 30 min), STO oversold, so might be a bounce at least tomorrow morning.

1.0.4 S&P 500 SPDRs (SPY 15 min), might be a Bullish Falling Wedge, but since there are no positive divergence to support it, so don't hope too much.

Now the bad news:

2.8.2 SPX:CPCE, sell off might be ahead of schedule. It cannot wait until NYADV gets overbought which is a perfect "loading" chances for bears.

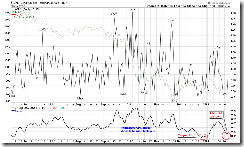

2.8.0 CBOE Options Equity Put/Call Ratio, remember how I called top here 01/07/2009 Market Recap: Intermediate-term Top?? Now this indicator comes back, so if market drops again tomorrow...

2.8.1 CBOE Options Total Put/Call Ratio, pay attention to the "Normalized CPC" at bottom, a little bit too low, right? Yes, I said CPC low readings are bullish, but I also said, there'll be a payback time as CPC cannot remain at 0.8 level for ever.

0.0.2 SPY Short-term Trading Signals, all the red circles, at least not much up room left right? And this is why I mentioned at the very beginning that any bounce is a gift for bulls.

0 comments:

New comments are not allowed.