| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

|

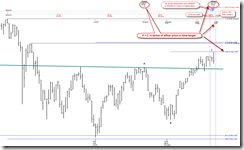

SHORT-TERM: BEARISH, BUT SPX NEED TO BREAKDOWN BELOW 1136 TO CONFIRM THE DOWNTREND

The bottom line, bulls are not optimistic:

1. SPY formed another Bearish Reversal Bar (Open high, goes higher high but closes in red) today which is the 2nd Bearish Reversal Bar within 4 days and the 4th consecutive reversal like bars.

2. Could be a typical A = C pattern, in terms both price and trading days. Also it is within the 09/28 to 10/01 time window that seems a logical time for a trend change to happen.

For now, the downtrend has not confirmed yet. Bears still need to push bulls down below SPX 1136 to confirm the short-term downtrend (see 1-2-3 Trend Change pattern at the bottom of the chart below) which if indeed, I expect at least 2 leg down thereafter. The only thing not sure for bears is whether the back test to the broken trend line was enough or the high at 1157 still needs to be tested? We’ll have to see tomorrow. While for bulls, apparently hold above 1136 is absolutely necessary while to resume the bullish uptrend, a decisive breakout above 1157 is needed.

INTERMEDIATE-TERM: BULLISH, BUT NEED SOME IMAGINATION TO FORESEE HOW BULLISH

See 09/27 Market Recap for more details.

SEASONALITY: LAST TRADING WEEK OF MONTH WAS GENERALLY BEARISH

See 09/24 Market Recap for more details.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

| TREND | COMMENT | |

| QQQQ | LA | 4.1.1 Nasdaq 100 Index (Weekly): NDX to SPX ratio too high. |

| IWM | UP | *Bearish reversal bar, pullback? |

| CHINA | ||

| EMERGING | UP | 4.1.6 iShares MSCI Emerging Markets (EEM Weekly): EEM to SPX ratio too high. *1.4.1 iShares MSCI Emerging Markets (EEM Daily): Black bar, pullback? |

| CANADA | UP | TOADV MA(10) too high, pullback? *Black bar, pullback? |

| BOND | LA | 4.2.0 20 Year Treasury Bond Fund iShares (TLT Weekly): Morning Doji Star? |

| EURO | UP | *Black bar, pullback? |

| GOLD | UP | *Hanging Man? |

| GDX | *LA | 4.3.1 Market Vectors Gold Miners (GDX Weekly): GDX to SPX ratio too high. |

| OIL | UP | *Breakout, bullish. |

| ENERGY | UP | *Black bar, pullback? |

| FINANCIALS | DOWN | 4.4.2 Financials Select Sector SPDR (XLF Weekly): Head and Shoulders Top in the forming? |

| REITS | DOWN | 4.4.3 Real Estate iShares (IYR Weekly): Home builder is lagging. |

| MATERIALS | DOWN |

- Please make sure you understand how to use the table above. The purpose of this report is to provide info so contradictory signals are always presented.

- Conclusions can be confirmed endlessly, but trading wise, you have to take actions at certain risk level as soon as you feel the confirmation is enough. There’s no way for me to adapt to different risk levels therefore no specific buy/sell signals will be given in this report except the mechanical signals such as SPY ST Model.

- * = New update.

- Blue Text = Link to a chart in my public chart list.

- LA = Lateral Trend.