| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

|

SHORT-TERM: DIRECTION NOT CLEAR, LET’S WAIT FOR TOMORROW

Clueless today, breakout on the upside then we’ll have an Ascending Triangle while breakdown we’d have a Double Top. For now, it’s really hard to say which side weights more, so let’s see tomorrow.

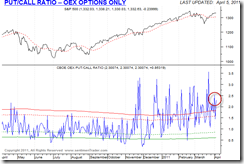

Two charts worth some attentions, neither are extreme enough, so info only.

SPY had 3 consecutive reversal like bars (solid black bar = open high close lower but still above the last close, hollow red bar = open low close higher but still below the last close, both imply that bulls and bears are fighting for the control therefore could mean a reversal is pending) which looks bearish. However, since those reversal bars stopped working recently so I’m not sure if they’d work or not this time.

OEX option traders keep buying put. As I mentioned before, historically, those OEX option traders are usually right, so this is not a good sign.

INTERMEDIATE-TERM: BULLISH APRIL, SPX TARGET 1352 TO 1381, BEWARE 04/11 TO 04/14 PIVOT DATE

See 04/01 Market Recap for more details.

SEASONALITY: APRIL HAS BEEN HISTORICALLY THE MOST BULLISH MONTH OF THE YEAR

See 04/01 Market Recap for more details.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

| TREND | COMMENT | |

| QQQQ&Weekly | UP | |

| IWM & Weekly | UP | |

| SSEC & Weekly | UP | Ascending Triangle, so may go higher from here. |

| EEM & Weekly | UP | |

| XIU & Weekly | UP | |

| TLT & Weekly | UP | |

| FXE & Weekly | UP | |

| GLD & Weekly | UP | |

| GDX & Weekly | *04/05 L | |

| USO & Weekly | UP | |

| XLE & Weekly | UP | |

| XLF & Weekly | DOWN | |

| IYR & Weekly | UP | |

| XLB & Weekly | UP | |

| DBA & Weekly | DOWN |

- Please make sure you understand how to use the table above. The purpose of this report is to provide info so contradictory signals are always presented.

- * = New update; Blue Text = Link to a chart in my public chart list.

- UP = Intermediate-term uptrend. Set when weekly buy signal is triggered.

- DOWN = Intermediate-term downtrend. Set when weekly sell signal is triggered.