| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

|

SHORT-TERM: CLUELESS, NEED WAIT AND SEE, SIGNAL IS BEARISH BIASED THOUGH

Clueless (as usual), let’s see the next week. Purely from the signals I’ll be presenting, chances for an intermediate-term top are pretty high. But, frankly, I’m now too scared to make any bearish conclusions as it seems never ever could they work in the planet Earth. Trading wise, however, it’s much simple, just stare at my short-term model. Whenever, I happily hold short position overnight (not the case when I say, I hold trapped short position overnight of course), then most likely the short-term downtrend is confirmed. For now, the model is to buy at close, so I hold long position over the weekend. Chances are high though, that I’d close the long with breakeven stop loss on Monday open. Unless, the market up huge on Monday, in which case, no doubt, the short-term trend is still up then.

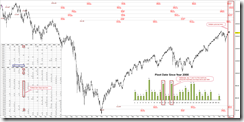

As mentioned in the Friday’s After Bell Quick Summary, for 8 consecutive reversal like bars on the SPY daily chart, chances are high that we should see further pullbacks. The chart below shows another angle, mostly the SPY bearish reversal bar would mean at least a short-term top, especially, never the chart had 2 failed bearish reversal bars in a row (i.e. no 2 consecutive blue arrows on the chart, which means a failed bearish reversal bar).

0.0.2 Combined Intermediate-term Trading Signals, frequent readers of this blog should know this is a very reliable top signal. The 3 points validated trend line was broken on Friday, now it just needs to hold the trend line the next Monday to seal the deal.

OEX Open Interest Ratio keeps rising as I’ve been blah blah recently as a not so good sign. The statistics below is from Sentimentrader:

This indicator settled into its current range starting around 1998. Beginning then, the 30-day forward return in the S&P 500 when the Open Interest Ratio exceeded 1.75 averaged -0.8%, with only 30% of the 63 days showing a positive return.

More importantly, the median maximum loss during the 30-day stretches was -5.0%, compared to a median maximum gain of +1.9%, so there was a consistent and relatively large negative bias to the market after such extremes.

The last but not the least, don’t forget the time window from 04/11 to 04/14 mentioned in the 04/01 Market Recap. We’re now within the time window. Besides, the 2 pivot dates we had this year were 02/18 and 03/16, so it’s another sign that 04/15 could be an important date (as 04/16 and 04/17 are weekend) which also happens to be in the time window I mentioned above.

INTERMEDIATE-TERM: BULLISH APRIL, SPX TARGET 1352 TO 1381, BEWARE 04/11 TO 04/14 PIVOT DATE

See 04/01 Market Recap for more details.

Three additional charts below, info only.

Never had I seen a stock market kept rising while commodity stopped rising or even dropped a lot. So, just image, how much gas would cost you when SPX is at the all time high?

The surge of TIP:TLT at least means the expectation for the rising inflation is high. I know, at least people in my forum are arguing that inflation is good for the stock market which, however, unfortunately, I don’t see it on the chart.

Lots negative divergence.

SEASONALITY: APRIL HAS BEEN HISTORICALLY THE MOST BULLISH MONTH OF THE YEAR

See 04/01 Market Recap for more details.

Also according to Stock Trader’s Almanac:

- Monday before expiration, Dow up 14 of last 21, down 4 of last 6.

- April expiration day, Dow up 11 of last 14.

- Income tax deadline, generally bullish, Dow down only 5 times since 1981.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

| TREND | COMMENT | |

| QQQ & Weekly | UP | |

| IWM & Weekly | UP | |

| SSEC & Weekly | UP | |

| EEM & Weekly | UP | *Too high above weekly %B. |

| XIU & Weekly | UP | |

| TLT & Weekly | *DOWN | |

| FXE & Weekly | UP | |

| GLD & Weekly | UP | |

| GDX & Weekly | 04/05 L | |

| USO & Weekly | UP | |

| XLE & Weekly | UP | |

| XLF & Weekly | DOWN | |

| IYR & Weekly | UP | |

| XLB & Weekly | UP | |

| DBA & Weekly | *UP |

- Please make sure you understand how to use the table above. The purpose of this report is to provide info so contradictory signals are always presented.

- * = New update; Blue Text = Link to a chart in my public chart list.

- UP = Intermediate-term uptrend. Set when weekly buy signal is triggered.

- DOWN = Intermediate-term downtrend. Set when weekly sell signal is triggered.