| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

|

SHORT-TERM: NOT SURE IF THE FIRST DOWN LEG IS OVER, BUT CHANCES ARE HIGHER THAT THERE’LL BE A 2ND LEG DOWN THEREAFTER

I expect at least 2 leg down for the short-term. Because of today’s follow-through, now I have no question about this anymore. The only thing I’m not sure is whether the 1st leg down has completed? There’re some chances the answer is yes, but because the last SPY 60 min bar looks bearish plus RSI shows no sign of positive divergence yet, so 50 to 50 chances tomorrow we might have a lower low.

Two additional info I’d like your attention today:

0.0.2 Combined Intermediate-term Trading Signals, it’s primary sell, so those who follows Non-Stop model should find chances to close long in the coming days and if you want to be a little aggressive then you can short while closing the long. The model had a very impressive run by holding longs since 09/07. Another thing worth attention is that the CPCE trend line breakout is confirmed today, so chances are good that the market has topped at least for the short-term.

0.1.0 SPY Short-term Trading Signals, according to TradingMarkets, quite a few short-term long setup has been triggered. All claimed to have a winning rate above 80%+, however, I have no idea how TradingMarkets tested them as they’re against using stop loss so not sure how they handle the failed cases. Anyway, info only.

INTERMEDIATE-TERM: PULLBACK SINCE 02/22 WILL LAST FOR 4 WEEKS ON AVERAGE BUT THE 02/18 HIGH WILL BE REVISITED THEREAFTER

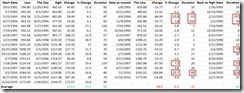

The 2.5%+ pullback I’ve been blah blah has finally fulfilled. A little bit late as it lasted 65 trading day, but at least now we have some clue about what’s going on the next. The table below listed all the past up 40+ trading days without 2.5%+ pullback cases. Clearly, we can see:

- Once the pullback starts, on average it drops 5.5%, but 12 out of 16 (75%) chances, the pullback is less than 5%.

- Pullback on average could last 25 calendar days. Only 3 out of 16 (19%) chances, the 02/18 high is THE HIGH for a long long time.

- After the pullback, on average the 02/18 high will be revisited in 45 calendar days. Among them, 11 out of 16 (69%) chances, the rebound to new high is within 3 weeks.

So to summarize above, the pullback may last on average 4 weeks but chances are high after that the 02/18 high will be revisited.

SEASONALITY: BEARISH THE NEXT WEEK

See 02/18 Market Recap for more details.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

| SIGNAL | COMMENT | |

| QQQQ | 01/28 S | *Testing MA(50). |

| NDX Weekly | UP | |

| IWM | *Testing MA(50). | |

| IWM Weekly | UP | |

| CHINA | ||

| CHINA Weekly | UP | No higher low yet but the rebound is so strong so could be in uptrend now. |

| EEM | ||

| EEM Weekly | DOWN | |

| XIU.TO | 02/04 L | |

| XIU.TO Weekly | UP | Too far above MA(200), %B too high. |

| TLT | Could be a channel breakout, trend may about to change. | |

| TLT Weekly | DOWN | |

| FXE | ||

| FXE Weekly | UP | |

| GLD | ||

| GLD Weekly | UP | |

| GDX | 02/03 L | |

| GDX Weekly | UP | |

| USO | Clear breakout on WTIC chart. | |

| WTIC Weekly | UP | |

| XLE | 02/09 S | |

| XLE Weekly | UP | Too far above MA(200). |

| XLF | 10/15 L | *Testing MA(50). |

| XLF Weekly | UP | |

| IYR | *Testing MA(20). | |

| IYR Weekly | UP | |

| XLB | 02/09 S | *Testing MA(50). |

| XLB Weekly | UP | BPMATE is way too overbought. |

- Please make sure you understand how to use the table above. The purpose of this report is to provide info so contradictory signals are always presented.

- Conclusions can be confirmed endlessly, but trading wise, you have to take actions at certain risk level as soon as you feel the confirmation is enough. There’s no way for me to adapt to different risk levels therefore no trading signals will be given in this report except the mechanical signals such as SPY ST Model.

- * = New update; Blue Text = Link to a chart in my public chart list.

- Trading signals in OTHER ETFs table are mechanical signals. See HERE for back test results. 08/31 L, for example, means Long on 08/31.

- UP = Intermediate-term uptrend. Set when I see at least one higher high and higher low on daily chart.

- DOWN = Intermediate-term downtrend. Set when I see at least one lower high and lower low on daily chart.