OK, we got a follow-through on Friday, but I'm not happy, because the bounce was weak and on decreased volume. Maybe it's because of the long weekend and OE day effect, but anyway, next Tuesday, the market must up big otherwise, bulls will be in trouble.

7.0.3 NYSE Composite Index Breadth Watch, this is the main reason why I'm not happy. According to "Equal up down strength" rule, bulls have 4 days left to prove themselves.

Let's see if by any chances this short-term bounce can last for awhile:

0.0.2 SPY Short-term Trading Signals, 2 hammers plus STO buy signal triggered very close to its oversold area, so under normal conditions the bounce is likely to continue.

Charts from www.stocktiming.com, from Liquidity Flow and Institutional "shift in direction" point of view, they're still at very low level.

Again, Institutional Buying and Selling Trending chart from www.stocktiming.com which I first introduced on Christmas day. Now blue curve is well bellow the red curve which means a distribution and therefore a downtrend in intermediate-term. The good news is that the blue curve is too low and therefore justifying a possible short-term rebound.

OK, now the possible rebound target:

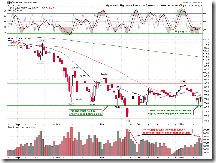

1.0.3 S&P 500 SPDRs (SPY 30 min), potential Head and Shoulders Bottom, the theoretical target happens to be Fib 61.8 level.

Cobra can not enter Hutong

ReplyDelete01/19/2009 ET 3:50 PM

What do you mean? Don't understand. Hutong is OK, unless you're in China.

ReplyDeleteWhat is Hutong, and why can't Cobra enter it?

ReplyDeleteCobra, any idea why U.S. market futures swung dramatically from positive to negative over the course of the weekend?

ReplyDeleteHutong is a Chinese forum where I post my Chinese version daily report. QSCNC probably means that he/she could not enter Hutong which I think is impossible unless he/she is in China.

ReplyDeleteFor the futures dramatical changes, I think we need to see tomorrow. For very long time, I've found it's very interesting that whenever the world tanks while US market is closed, the 2nd day, the US market does generally well. We'll see.

Cobra: I am in Canada, from 01/19 3:30 PM , I cannot access Hutong site both from home and working place. Now is 10:45 pm, same thing happen. My ID IN Hutong is QSCNC too. If you can enter Hutong, please let me know from here. Thanks.

ReplyDeleteI've checked Hutong, nothing wrong there. Your ID is OK as well. You sure you've got the right address? http://www.hutong9.com/forumdisplay.php?fid=27

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteCobra,

ReplyDeleteNow is OK by copying the full address you give to me.

Thank you very much.

You can try to release IP and renew IP. Go to command prompt, then type ipconfig /release then ipconfig /renew, also you can try ipconfig /flushdns. I checked on the Hutong console, no one prohibited your IP, so should be OK.

ReplyDeleteOK, got you. Wrong address, looks like.

ReplyDeleteCobra,

ReplyDeleteI report :main page of Hutong has problem, Cannot access.

No problem, I checked. Something wrong with your computer settings.

ReplyDeleteCobra,

ReplyDeleteAnyway, I can access now, very good to me,

thanks.

It looks like financials tanked sharply in Europe while U.S. markets are closed. Do you think we will see financials tank in the U.S. on Tuesday?

ReplyDeleteI doubt that. But if it does tank tomorrow, I cannot disagree. :-)

ReplyDelete