| |||||||||||||||||||||||||

| |||||||||||||||||||||||||

| |||||||||||||||||||||||||

|

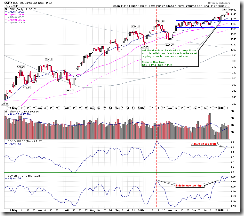

INTERMEDIATE-TERM: EXPECT HEADWIND AHEAD

No update, watch 4.1.0 S&P 500 Large Cap Index (Weekly) for overhead target/resistance and 4.0.4 Dow Theory: Averages Must Confirm for overbought breadth signals.

SHORT-TERM: MAY REBOUND BUT COULD BE MORE PULLBACKS AFTERWARDS

Take a look at today’s After Bell Quick Summary first please: I have no idea if the pullback is over or not, but for sure sooner or later, there’ll be a -1,000 TICK readings, this means at least there’ll be a moment of panic sellings ahead.

If you paid attention to the trend table comment area, you might have noticed that lots of short-term bearish signs were fixed, but still the put call ratio is at very extreme level so even if the market rebound to a new high, it eventually will pullback, therefore I think from now on it’s better to reduce long positions whenever the market rallies.

0.0.9 Extreme Put Call Ratio Watch.

0.0.3 SPX Intermediate-term Trading Signals.

www.sentimentrader.com % of Indicators at bearish extremes are still high, maybe not very extreme but if there’s a huge rebound tomorrow then most likely tomorrow night I’ll again bring out this chart to scare (in vain) the fearless bulls. LOL

INTERESTING CHARTS: NONE