| ||||||||||||||||||

| ||||||||||||||||||

| ||||||||||||||||||

|

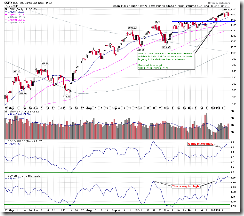

INTERMEDIATE-TERM: STALLED AT HEADWIND BUT OVERALL IS HEALTHY

4.0.2 NYSE Advance-Decline Issues, looks like everything is inline.

4.0.3 Primary and Secondary Indices Divergence Watch, Semi and Transport a little crack, but not big enough to be a concern.

4.0.4 Dow Theory: Averages Must Confirm, a Doji was formed under important resistances, plus lots of overbought breadth showing above, so it does look like it’s stalled, but need see a follow through next week.

Climax Buying spiked again (see red bar below), not good, but too need see follow through next week.

All in all, the uptrend is intact. A little little little bit not prefect but far from a big concern, let’s wait to see how the next week unfolds.

SHORT-TERM: IN WAIT AND SEE MODE BUT STILL THINK IT IS PRUDENT TO REDUCE LONGS

The biggest problem in short-term is still 0.0.3 SPX Intermediate-term Trading Signals CPC and CPCE MA10 are way too low. These kind of extremely low values all led to a further pullbacks in 2009.

The chart below is ISEE Equities Only Index representing call buying from retailers only. Although the current value is very high, however from a longer history view (highlighted in red), choppy ahead for sure, but it didn’t necessarily lead to an immediate pullback.

So to summarize, although there’s not any immediate sell off signals, but trading wise, as illustrated above, the current put call ratio is too bullish, therefore it needs to be fixed sooner or later, so I still think it’s risky to hold very heavy long positions now. Reduce some if possible.

0.0.8 SPX:CPCE, trend line breakout which means a top, but again, need at least hold through the next Tuesday.

As mentioned in the Friday’s After Bell Quick Summary, because VIX fell sharply before the close so it could mean a rebound the next Tuesday. However, since VIX is already dropped out of BB in chart 1.0.4 S&P 500 SPDRs (SPY 15 min) (Yes, VIX out of BB setup does work in intraday chart too), plus SPY has 15 unfilled gaps already, so a gap up open the next Tuesday is very likely to be filled.

There’s another problem if gap up open the next Tuesday, 1.0.9 SPX Cycle Watch (60 min), a cycle is due soon, so the Tuesday’s gap up if any, could mean a cycle top.

So to summarize above, bears who didn’t cover on Friday may have chance to escape unharmed if indeed we have yet again another very very bullish Tuesday.

INTERESTING CHARTS: NONE