| |

| |

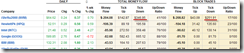

| SPY SETUP | ENTRY DATE | INSTRUCTION | STOP LOSS | Mechanic trading signals, details are HERE.

Take profit whenever you see appropriate. | | ST Model | 12/21 L | | 12/31 Low | | | Reversal Bar | | | | | | NYMO Sell | | | | | |

| |

INTERMEDIATE-TERM: EXPECT HEADWIND AHEAD

No update, watch 4.1.0 S&P 500 Large Cap Index (Weekly) for overhead target/resistance and 4.0.4 Dow Theory: Averages Must Confirm for overbought breadth signals.

SHORT-TERM: NATV TO NYTV RATIO ROSE EVEN HIGHER

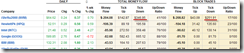

The same old problem, CPC and CPCE are extremely low (see table above) and www.sentimentrader.com has too many indicators at bearish extremes. So still think it’s better to reduce long position.

2.3.4 Nasdaq Total Volume/NYSE Total Volume, moved even higher which means people are crazy about high beta stocks. This usually is a sign of extreme bullishness therefore could mean a top. Also Rydex traders seem to extremely like Nasdaq too. Anyway, I’m not calling a top, I just mean better be safe then sorry.

The most recent II and AAII Bull Ratio, also at extreme level.

INTERESTING CHARTS:

Take a look if interested, I don’t know if 251 / 346 = 73% outflow was block sell today means IWM bearish tomorrow or not?

1.0.8 SPX Cycle Watch (Moon Phases), if you believe look at the moon is not superstitious then click the link see for yourself.

Disclaimer

The information contained on this website and from any communication related to the author’s blog and chartbook is for information purposes only. The chart analysis and the market recap do not hold out as providing any financial, legal, investment, or other advice. In addition, no suggestion or advice is offered regarding the nature, profitability, suitability, sustainability of any particular trading practice or investment strategy. The materials on this website do not constitute offer or advice and you should not rely on the information here to make or refrain from making any decision or take or refrain from taking any action. It is up to the visitors to make their own decisions, or to consult with a registered professional financial advisor.

This websites provides third-party websites for your convenience but the author does not endorse, approve, or certify the information on other websites, nor does the author take responsibility for a part or all materials on the third-party websites which are not maintained by the author.