| ||||||||||||||||||||||

| ||||||||||||||||||||||

| ||||||||||||||||||||||

|

INTERMEDIATE-TERM: THE CORRECTION TARGET FOR INDU COULD BE AROUND 9727

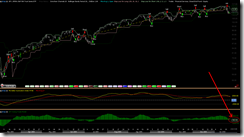

No update. According to chart 4.0.4 Dow Theory: Averages Must Confirm, the correction target could be around 9727.

SHORT-TERM: FED DAY USUALLY WAS AN UP DAY

Since SPY ST Model is switched to sell mode today, so all the buy dip setups in the table above are cancelled. From now on only short setup will be triggered.

0.0.3 SPX Intermediate-term Trading Signals, looks like a 2 day consolidation pattern, so the direction is unknown. Trading wise, this could be a narrow range bar base band breakout setup – long if breakout above today’s high, short if breakdown below today’s low. For me, because SPY ST Model is in sell mode now, so I’ll short only on breakdown.

Fed day tomorrow, anything could happen, one thing is for sure though: After 2:15pm there’ll be a roller coaster show. From chart 6.4.3 SPX and FOMC, we can see more likely tomorrow will be an up day. As mentioned in today’s After Bell Quick Summary, according to 6.2.4a SPX and VIX Divergence Watch, also more likely an up day tomorrow.

The chart below is from Bespoke Premium, it says Fed day is more likely to rise especially in the morning, but normally there’ll be a sell off before the close.

Nothing else to say, there’re 2 charts, I’d like your attention, no conclusion though, let’s wait and see.

VIX could be topped. This is good for bulls. Besides, lots of indicators are very close to extremely oversold, so there could be a short-term bounce soon and even the market could be bottomed now.

Mentioned in today’s After Bell Quick Summary, QQQQ block sell was large, I’m not sure if we should be altered, just remind you again here, as from my forum, I see most people don’t read my After Bell Quick Summary (although most do read my market recap), so I assume maybe the blog is the same that most people come here for market recap only.

INTERESTING CHARTS: NONE