| ||||||||||||||||||||

| ||||||||||||||||||||

| ||||||||||||||||||||

|

INTERMEDIATE-TERM: EXPECT HEADWIND AHEAD

No update, watch 4.1.0 S&P 500 Large Cap Index (Weekly) for overhead target/resistance and 4.0.4 Dow Theory: Averages Must Confirm for overbought breadth signals.

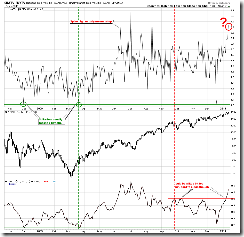

SHORT-TERM: ONE MORE TOP SIGNAL AND SEASONALITY IS BEARISH FOR QQQQ UNTIL THE END OF JANUARY

Still the same problem, CPC and CPCE are extremely low and www.sentimentrader.com has too many indicators at bearish extremes. In addition, there’s another potential top signal triggered: 2.3.4 Nasdaq Total Volume/NYSE Total Volume. So still suggest reducing long positions.

Seasonality, according to www.sentimentrader.com, since 2002, QQQQ performance was bad starting from the 8th trading day of each year (i.e. Today)until the end of January. I’ve prepared all the charts for you to verify, just they’re too many, so please click the link below to see for yourself.

8.2.9a QQQQ – 2009

8.2.9b QQQQ – 2008

8.2.9c QQQQ – 2007

8.2.9d QQQQ – 2006

8.2.9e QQQQ – 2005

8.2.9f QQQQ – 2004

8.2.9g QQQQ – 2003

8.2.9h QQQQ – 2002

INTERESTING CHARTS: NONE