| ||||||||||||||||||||

| ||||||||||||||||||||

| ||||||||||||||||||||

|

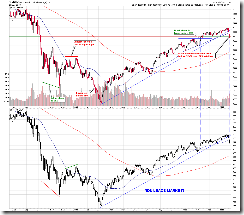

INTERMEDIATE-TERM: THE CORRECTION TARGET FOR INDU COULD BE AROUND 9727

I’ve been mentioning quite a few reliable top signals recently:

Although they cannot tell whether the top is short-term or intermediate-term, but based on the Thursday and Friday’s violent sell off, very likely this is an intermediate-term top.

4.0.4 Dow Theory: Averages Must Confirm, so based on the past similarities, the correction target could be at 9727ish (about 9%).

Climax Buying for 2 weeks in a row (see red bar), this also means that the correction could last for a few weeks.

Because the sell off was after this week’s II and AAII survey, so maybe we should wait for the next week’s survey. The charts below are this week’s II and AAII Survey, just have a look. Basically, II is still very bullish.

SHORT-TERM: PAY ATTENTION TO A POTENTIAL VIX BUY SIGNAL

Short-term, as mentioned in the After Bell Quick Summary, the very first rebound after a big sell off usually will fail, while there’s not even the very first rebound yet, so the sell off may not be over yet. However, because ChiOsc is way too low plus VIX has formed a reversal like bar right before the close, so there could be a rebound in Monday morning.

1.2.0 INDU Leads Market, INDU has penetrated the so called strong support area, expect SPX to follow. This is another evidence that the sell off may not be over yet.

I know, now the most wanted question for bulls is when a rebound will be? Either of 2 conditions listed below are met, then the rebound could be very close:

2.0.0 Volatility Index (Daily), too panic, so if an out of BB reversal bar could be formed then bull has hopes. Those who want to buy dip, please pay attention to the table above for the VIX MA ENV Setup trigger conditions.

If VIX MA ENV Setup not met then in the table above, I also listed 3 of my favorite indicators. For now, only one is oversold, so NOT YET. Chart for those 3 indicators are listed below for your conveniences.

2.4.2 NYSE - Issues Advancing.

2.4.4 NYSE McClellan Oscillator.

T2122 4 week New High/Low Ratio.

INTERESTING CHARTS: NONE