| ||||||||||||||||||||

| ||||||||||||||||||||

| ||||||||||||||||||||

|

INTERMEDIATE-TERM: UPTREND INTACT WITH STRONG SUPPORT BELOW

The sell off today didn’t change anything. Although in today’s After Bell Quick Summary, I think there might be another down leg, but as illustrated in chart 0.0.3 SPX Intermediate-term Trading Signals, a huge consolidation area below should serve as a strong support which is unlikely being penetrated on the very first attempt. So let’s define the sell off today as a short-term pullback first. The intermediate-term uptrend is intact.

SHORT-TERM: PAY ATTENTION TO A POTENTIAL VIX BUY SIGNAL

I have no solid proof to talk you into believing whether this is a short-term pullback or the beginning of an intermediate-term downtrend although the feeling is not good, as the sell off was very strong and so was the volume. I think char 2.0.0 Volatility Index (Daily) is worth of a close attention. If still this is the old same, no later than next Monday (don’t you forget the very very bullish Monday?), we should see a huge rebound. While if until the next Monday we don’t see any meaningful rebound then most likely this time is different. Until then, again, let’s define the sell off today as a short-term pullback first.

6.2.0a VIX Trading Signals (ENV), take a look at the VIX MA ENV buy setup. No buy signal yet today. As usual, I just report whatever info I gather, it doesn’t mean that I imply that you should buy this dip. In fact whether this is a buyable dip, I have no idea.

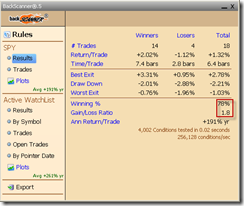

The back test summary of the above setup is posted below. Please note, in order to trigger a buy, VIX must fall back into it’s MA envelop, besides there’s one additional condition: SPY Close > Open.

INTERESTING CHARTS: NONE