The bottom line, the short-term trend is not clear. I hold long position overnight for speculation play only.

A little bit bullish biased toward tomorrow. The evil plan is still 3 push up therefore we may still miss the final push up to form either a higher high (most likely because the RSI negative divergence is not enough) or lower high. There’re some chances though that today’s high was the 3rd push up high (so the 2 legged down has already started) but I’ll present some evidences that the 3rd push up high is still likely in tonight’s report.

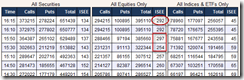

One interesting thing though, retailers bought huge equities CALLs when the market was being sold off. Bullish sign or bearish sign? Well, you tell me?

Demo account for short-term model, $200 max loss allowed per trade. Mechanical trading signal, for fun only.

| TICKER | Entry Date | Entry Price | Share | Stop Loss | Exit Date | Exit Price | Profit | Comment |

| SSO | 03/28/2011 | $52.02 | 100 | $50.97 | Half positioned, may add more. | |||

| SSO | 03/25/2011 | $52.29 | 100 | $50.97 | 03/25/2011 | N/A | N/A | No guts to take the trade. |

| SSO | 03/24/2011 | $51.62 | 100 | $49.91 | 03/28/2011 | $52.39 | 77.00 | |

| SSO | 03/23/2011 | $50.72 | 200 | $49.43 | 03/24/2011 | $51.69 | 194.00 | |

| SDS | 03/23/2011 | $22.29 | 300 | $21.58 | 03/24/2011 | $21.50 | -237.00 | |

| SDS | 03/17/2011 | $22.83 | 200 | $21.58 | 03/22/2011 | $22.02 | -162.00 | |

| SDS | 03/16/2011 | $22.81 | 200 | $21.85 | 03/16/2011 | $23.36 | 110.00 | |

| SDS | 03/15/2011 | $22.50 | 200 | $21.58 | 03/16/2011 | $22.60 | 20.00 | |

| SDS | 03/14/2011 | $22.01 | 200 | $21.02 | 03/15/2011 | N/A | N/A | Network problem, didn’t take the trade. |

| SDS | 03/14/2011 | $22.08 | 200 | $21.02 | 03/14/2011 | $22.17 | 18.00 | |

| SSO | 03/07/2011 | $52.17 | 100 | $50.84 | 03/09/2011 | $52.57 | 40.00 | |

| SSO | 03/04/2011 | $53.01 | 100 | $50.84 | 03/07/2011 | $53.23 | 22.00 | |

| SSO | 03/03/2011 | $53.33 | 100 | $51.52 | 03/04/2011 | $53.49 | 16.00 | |

| SDS | 03/01/2011 | $21.37 | 200 | $20.62 | 03/01/2011 | $21.76 | 78.00 | |

| SSO | 02/28/2011 | $53.09 | 100 | $52.20 | 03/01/2011 | $53.69 | 60.00 | |

| SDS | 02/22/2011 | $21.05 | 300 | $20.62 | 03/10/2011 | $21.82 | 231.00 | |

| LAST | 691.00 | |||||||

| SUM | 1158.00 |