| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

|

SHORT-TERM: EXPECT SOME WEAKNESS AHEAD

Three cents:

- Could see pullback the next week, but before that likely there’s one more push up.

- Still expect 03/16 lows will be retested before the new high. I’m not as confident as when I was in the Friday’s intraday comment now, but still bears have chances.

- The trading strategy is still to buy dips.

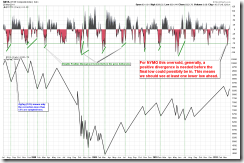

Why there’s one more push up? Because the RSI negative divergence is still missing. I’ve demonstrated the history lots of times in the past so I won’t bother to show the past chart here again. The logic is simple, RSI represents momentum, so RSI negative divergence means the momentum is weakening which is the very first step toward a price pullback. This is equivalent to reverse a forward accelerating car that you need reduce the speed first before backward is possible, assume, of course, you’re on Earth. We Martian, however, don’t go backward just like your stock market that never falls.

Why expect a pullback the next week? Besides the bearish last few trading days of the month as mentioned in the seasonality session, VIX 18% below MA(10), short at Friday’s close and cover 1 day and 5 days later since year 2000, well, I know, me included, it should be really really (insert 100 really) hard to imagine that this market would pullback, but after all, the 80% to 90% odds on the downside should not be ignored.

About the retest of 03/16 lows, my main argument is there is no visible NYMO positive divergence and the secondary evidence is 6 vs 7, bulls advanced less than that of bears therefore by definition this is a sellable bounce. However, about this 6 vs 7, I might read it wrong, instead, it should be 9 vs 9, so bulls still have 2 more days to prove themselves. And this is why at the very begging of this post, I said now I’m not as confident as when I was in the Friday’s intraday comment, because the battle is not over yet.

The chart below demonstrated the validity of applying the n vs n rule to confirm THE BOTTOM because some commented that the rule was made in 2008 bear market (See 8.0.3a Use n vs n Rule to Identify a Trend Change – 2008) so maybe useless now. Well, let’s take a look at all the major bottoms since the 2009 bull market below. Granted, the rule doesn’t work 100% times but still effective in most cases, right? OK, let’s see if bulls can break above SPX 1332 by the next Tuesday.

INTERMEDIATE-TERM: BULLISH IN 3 TO 6 MONTHS

Combine the study mentioned in 02/23 Market Recap and 03/11 Market Recap, I still believe that 02/18 high will be revisited.

SEASONALITY: BEARISH 03/31, BULLISH 04/01

According to Stock Trader’s Almanac:

- Last trading day of March, Dow down 11 of last 16, Russell 2000 up 12 of last 16.

- Frist trading day in April, Dow up 13 of last 16.

See Friday’s After Bell Quick Summary for seasonality chart for the last 2 and the 1st trading days of the month.

For March seasonality chart please refer to 03/01 Market Recap.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

| TREND | COMMENT | |

| QQQQ&Weekly | DOWN | |

| IWM & Weekly | UP | |

| SSEC & Weekly | UP | |

| EEM & Weekly | *UP | |

| XIU & Weekly | UP | |

| TLT & Weekly | UP | |

| FXE & Weekly | UP | |

| GLD & Weekly | UP | |

| GDX & Weekly | 03/23 L | |

| USO & Weekly | UP | |

| XLE & Weekly | UP | |

| XLF & Weekly | DOWN | |

| IYR & Weekly | UP | |

| XLB & Weekly | *UP | |

| DBA & Weekly | DOWN |

- Please make sure you understand how to use the table above. The purpose of this report is to provide info so contradictory signals are always presented.

- * = New update; Blue Text = Link to a chart in my public chart list.

- UP = Intermediate-term uptrend. Set when weekly buy signal is triggered.

- DOWN = Intermediate-term downtrend. Set when weekly sell signal is triggered.