| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

|

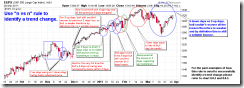

SHORT-TERM: COULD SEE HIGHER HIGH TOMORROW

Five cents:

- Could see higher high tomorrow. If up huge then the 3 push up pattern I’ve been blah blah recently would become invalid.

- Before seeing huge up tomorrow, I’ll maintain the forecast mentioned in 03/25 Market Recap that the 03/16 lows will be retested before the new high.

- Both of my 2 intermediate-term trading models are in buy model now but there’s catch need to explain.

- Trading wise, the name of the game is still to buy dip.

- Combining the 3 factors mentioned below, if you’re an aggressive traders then you may want to bet your luck on the downside for the very short-term.

- VIX 18% below MA(10) mentioned in 03/25 Market Recap. Valid for 5 trading days and today is day 2.

- Statistics about Bearish Engulfing and Bearish Reversal Day pattern mentioned in 03/28 Market Recap. Valid for 5 trading days and today is day 1.

- The seasonality mentioned in today’s After Bell Quick Summary. Valid for tomorrow and the day after tomorrow.

Why higher high likely tomorrow?

Since SPY doesn’t have higher high yet therefore the RSI negative divergence is still missing.

1.2.0 INDU Leads Market, so expect SPX to follow as early as tomorrow.

Why still believe the 03/16 lows will be retested? Except the number 5 “cent” mentioned above, because 9 vs 9, bulls lost the momentum battle today. If, however, bulls are able to break above SPX 1332 tomorrow then the rule would no longer apply. As for the validity of applying the n vs n rule, please refer to 03/25 Market Recap.

Since buy signal was triggered on both Non-Stop and SPY ST Model today, so officially (to me) the intermediate-term trend is up now. However, there’re 2 things I’d like your attention:

- As NYSI is not buy so Non-Stop is not officially in buy mode yet. You may want to wait for a few days for the final confirmation.

- The performance of the SPY ST Model this year is terrible. I’ve mentioned in the 03/25 intraday comment that I’d replace it with the Cobra Impulse which as of now I’m still testing. Cobra Impulse already issued long signal on 03/24, while today it requires the stop loss to be tightened and this is the additional reason that I mentioned above that an aggressive trade may want to bet his/her luck on the downside. The winning rate of the Cobra Impulse may not beat the SPY ST Model, but it’ll be very easy to follow. Unlike the SPY ST Model as you’ve experienced recently that at night I said we should have longed intraday while on the next day I said it’s now too late to follow and then on the 3rd day the position got stopped out. Instead, all entries provided by Cobra Impulse will be mentioned the day before it could be triggered.

INTERMEDIATE-TERM: BULLISH IN 3 TO 6 MONTHS

Combine the study mentioned in 02/23 Market Recap and 03/11 Market Recap, I still believe that 02/18 high will be revisited.

SEASONALITY: BEARISH 03/31, BULLISH 04/01

According to Stock Trader’s Almanac:

- Last trading day of March, Dow down 11 of last 16, Russell 2000 up 12 of last 16.

- Frist trading day in April, Dow up 13 of last 16.

See Friday’s After Bell Quick Summary for seasonality chart for the last 2 and the 1st trading days of the month.

For March seasonality chart please refer to 03/01 Market Recap.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

| TREND | COMMENT | |

| QQQQ&Weekly | DOWN | |

| IWM & Weekly | UP | |

| SSEC & Weekly | UP | |

| EEM & Weekly | UP | |

| XIU & Weekly | UP | TOADV MA(10) is way too high. |

| TLT & Weekly | UP | |

| FXE & Weekly | UP | |

| GLD & Weekly | UP | |

| GDX & Weekly | 03/23 L | |

| USO & Weekly | UP | |

| XLE & Weekly | UP | |

| XLF & Weekly | DOWN | |

| IYR & Weekly | UP | |

| XLB & Weekly | UP | |

| DBA & Weekly | DOWN |

- Please make sure you understand how to use the table above. The purpose of this report is to provide info so contradictory signals are always presented.

- * = New update; Blue Text = Link to a chart in my public chart list.

- UP = Intermediate-term uptrend. Set when weekly buy signal is triggered.

- DOWN = Intermediate-term downtrend. Set when weekly sell signal is triggered.