*Please make sure you understand how to use the table above. The main purpose of this report is to provide information so contradictory signals are always presented.

SEASONALITY: MOSTLY THE MONTH’S LAST TRADING WEEK WAS RED SINCE AUG 2009

See 04/23 Market Recap for more details.

CYCLE ANALYSIS: THE NEXT IMPORTANT DATE IS 05/06

The next potential turn date is 05/06 (+-) which could either be a top or a bottom depending on how the market marches to that date. See 04/16 Market Recap for more details.

INTERMEDIATE-TERM: EXPECT ROLLER COASTER AHEAD

See 04/26 Market Recap for more details.

SHORT-TERM: BIG RED TOMORROW MEANS MORE PULLBACK AHEAD WHILE SMALL BAR MEANS A BOTTOM

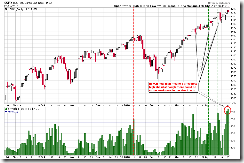

Take a look at 0.1.0 SPY Short-term Trading Signals and 0.1.2 QQQQ Short-term Trading Signals, technically, no damage yet, so the sell off today might not mean anything, need see tomorrow.

The 1.4.1 iShares MSCI Emerging Markets (EEM Daily) and 3.4.0 Financials Select Sector SPDR (XLF Daily) illustrate what I consider as technical damage: Both have formed a bearish 1-2-3 formation, confirming lower high (since 3 is lower than 1) and lower low (breakdown below 2 today forming a lower low), so officially we can say they’re in downtrend now (well, strictly speaking it depends on your time frame). Now, take a look at the SPY and QQQQ chart above again, even in the worst case, say, assume they’ll go down further, at the most they’re forming the 2 of a possible bearish 1-2-3 formation now, which is far away from confirming a downtrend, as firstly a lower high 3 is needed and after 3, a breakdown below 2 to confirm a lower low also is needed, so again SPY and QQQQ have no technical damage yet.

As illustrated in the chart below, tomorrow could be a key day: keep selling off then most likely a correction similar to the June 2009 we’ll see, while small red or green then most likely bottomed the market was (is).

My speculation about tomorrow has already been mentioned in today’s After Bell Quick Summary, for 4 reasons I expect a green day:

- 6.3.2a Major Distribution Day Watch, the day after a Major Distribution Day is more likely a green day.

- 6.5.1 SPX and FOMC, FOMC day (that’s tomorrow) is more likely a green day.

- 6.5.2b Month Day Seasonality Watch, the 3rd last trading day of a month is mostly a green day.

- 0.2.0 Volatility Index (Daily), according to the statistics about VIX surging more than 20%, very good chances the next day is a green day, at least won’t drop much.

So in another word, looks like bulls have more chances on both short and intermediate term.

In addition:

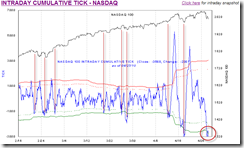

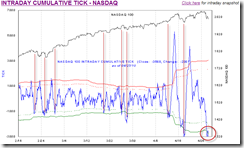

Today’s Nasdaq Intraday Cumulative TICK (courtesy of sentimentrader) is at very very extreme level so it also favors an up day tomorrow.

1.0.0 S&P 500 SPDRs (SPY 60 min), ChiOsc is way too low also says that at least we could see a rebound tomorrow morning.