SHORT-TERM: THE LOW COULD BE IN BUT MAY SEE A FEW DAYS OF BACK AND FORTH FIRST

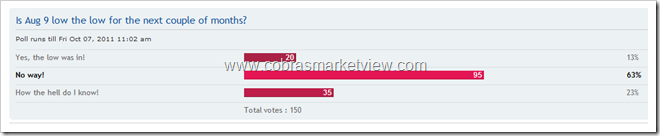

Very strange day today, on one hand, I have enough reliable evidences arguing it won’t be pleasant in the following several days after a later day rally like today, on the other hand, chart pattern as well as enough reliable evidences are arguing that the the low was in. Combining all those evidences together, my guess is the low was in or very close but bulls must prepare for a possible rollercoaster in the next couple of days.

Begin with evidences arguing for the low was in:

The 3 leg down pattern looks completed, especially the characteristics that the 3rd leg is much shorter than the 2nd leg and the huge consolidation area before the 3rd leg, matches perfectly.

Open low, lower low but closer high, today is called bullish reversal day. From the chart below, with almost no exception (green arrows) such a day at least MEANT a short-term bottom.

As mention yesterday, some signals cannot be argued. NYLOW around 1,000 is such a signal and today it goes even more extreme, so chances are much higher (than yesterday) that the low was in.

Now let’s see why rollercoaster in the next couple of days:

Later day sharp rally is always suspicious because institutions have not enough time to do the accumulation (therefore hardly such a day WAS a bottom). The statistics below is from Bespoke, looks like chances are high, a red tomorrow and no small drop.

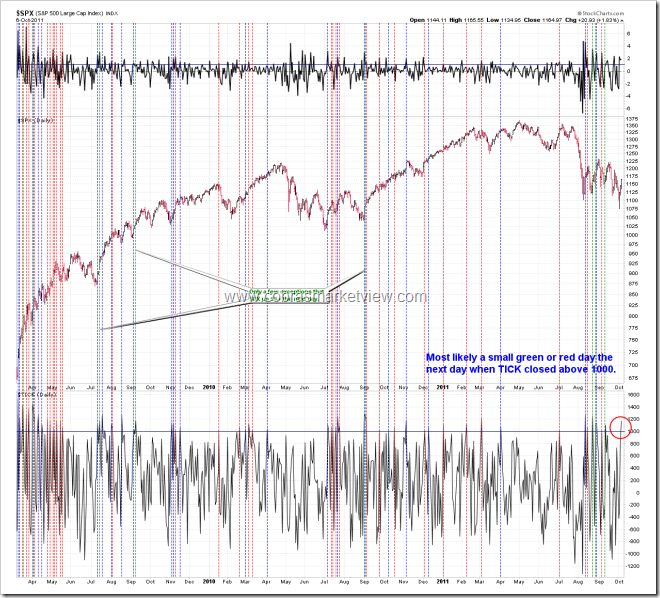

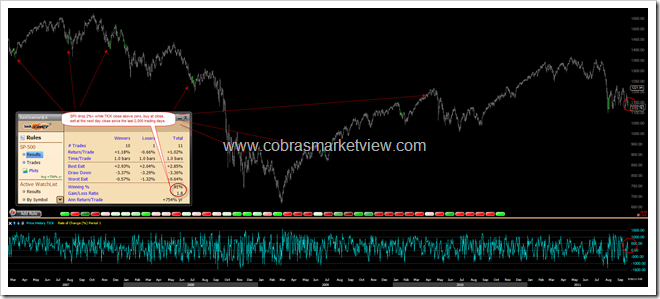

SPX up 1%+ but TICK closed below zero, as I've mentioned in 09/26 Market Outlook, tomorrow, the day after tomorrow, the day after the day after tomorrow and two weeks later WERE not pleasant. Let’s play a different test today: short at today’s close, hold (turn the computer off, or shall I see, turn your ipad off?) until the very first SPX red day, the winning rate WAS 100%, average holding period 1.3 trading days and 2.35% gains, not bad ha. In another word, if up huge again tomorrow, then chances are it would be completely erased the day after tomorrow. By the way, I’ve collected all the past similar cases from chart 8.3.8a SPX Up 1% while TICK Closed Red – 2004 to 8.3.8c SPX Up 1% while TICK Closed Red – 2010, take a look if interested, as more often than not you’d miss lots of valuable info if you merely read the numbers instead of looking at the chart directly.

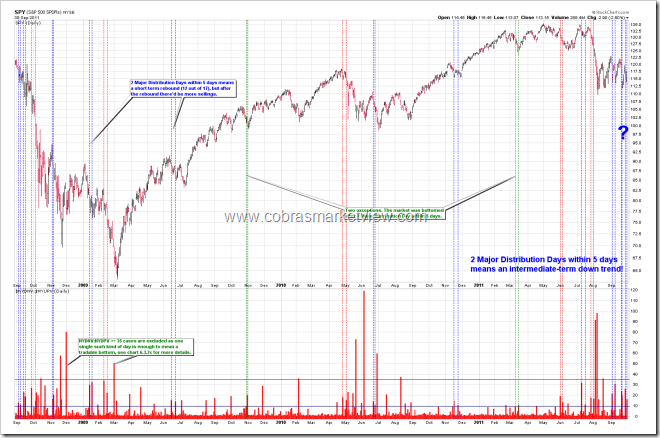

In 10/03 Market Outlook, I mentioned because NYADV too low so a lower close WAS almost guaranteed. If you read the chart carefully, you wouldn’t be surprised that we had a huge up day today, so everything was expected and therefore the forecast that SPX will close below its 10/03 close soon, is still valid, unless it’s another exception again which had 3 out of 24, about 13% chances.

SPX up 1.65%+ but not a Major Accumulation Day, although only 68% chances a red day tomorrow, but if you hold until the day after tomorrow, then 90% chances your short at close today would win something.

INTERMEDIATE-TERM: SPX DOWNSIDE TARGET IS 1,000, THE CORRECTION COULD LAST 1 TO 2 MONTHS

See 08/19 Market Outlook and 09/30 Market Outlook for details.

SEASONALITY: BEARISH MONDAY, BULLISH OCTOBER AND 4TH QUARTER

See 09/30 Market Outlook for details. The outlook also includes the October day to day seasonality chart.

SUMMARY OF SIGNALS FOR MY PUBLIC CHART LIST:

| |

| |

- * = New update; Blue Text = Link to a chart in my public chart list.

- UP = Intermediate-term uptrend. Set when weekly buy signal is triggered.

- DOWN = Intermediate-term downtrend. Set when weekly sell signal is triggered.

|