Summary:

Still suspect the current rally but I'll sure not trade against it.

Still expect a short-term pullback.

1.0.0 S&P 500 Large Cap Index (Weekly), the most common believe I saw is that this is still a bear market rally, the target could go as far as Fib 61.8 at 1250. The rally could last until Oct or next year.

And after the rally, there'd be a long last bear market similar to 1929. Borrowed a chart form Tim Knight’s Legends of the Fall, in which most believes that we are now within the green zone of the chart.

Well, is it true? Or is it possible a bull market has already started? Frankly, I have no idea about the market direction now because my signals are arguing for a top but the bullishness of the market makes me afraid of believing those signals. In today’s report, I’ll simply put all those signals together and let you make your own decisions. The bottom line is that I don’t believe this rally, but since almost all my intermediate-term signals are yelling for buy now therefore I won’t trade against them (This probably means I’ll trade lightly on the long side at the very beginning or simply stand on the sideline). Also via the Long Term Liquidity Flows from www.stocktiming.com, we can see that the liquidity has reached the previous bull market level. So unless something really really catastrophic happens which makes the Fed stop its money printing business, the market would find itself very hard to drop. And right now, via my human brain (which is already badly damaged by the recent bullishness) I really couldn’t think of anything that catastrophic.

Indicator Explanation: Long Term Liquidity is a measurement of Liquidity Injections flowing into the market from M3 and Foreign sources. Liquidity Expansion means that money inflows are at an expansionary rate which drives the market up. Decelerating Expansion is when the rate of inflows are decreasing while still net positive. Liquidity Contraction means that money inflows are being withdrawn from the markets at a level which is "net negative", and when this happens, the contraction results in a correction or pull back.

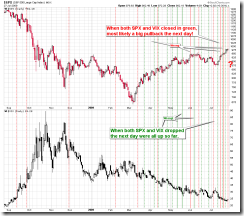

0.0.3 SPX Intermediate-term Trading Signals, NYADV and NYUPV negative divergence plus VIX:VXV sell signal plus various negative divergences. This chart is the main reason that I’m skeptical.

Compare the above chart with the 2003 bottom. It didn’t have above problems with the same indicator set. (VXV wasn’t introduced in year 2003, so there’s not VIX:VXV indicator.)

A longer history about NYADV and NYUPV negative divergence listed below.

2.3.3 NYSE Total Volume, I cannot explain why volume keeps decreasing since media paints so bullish about the market. 8.0.6 Use NYTV to catch the market top/bottom, here’s a longer history. Normalized NYTV as an indicator is pretty reliable.

2.3.4 Nasdaq Total Volume/NYSE Total Volume, this still looks like a top. 8.0.1 Use NATV/NYTV to catch the market top/bottom, here’s a longer history. Again, normalized NATV:NYTV is reliable too.

1.2.1 Dow Theory: Averages Must Confirm, $TRAN hasn’t confirmed the $INDU’s new high yet. Personally, I don’t consider this chart as very important because $TRAN may catch up later.

Short-term, I still expect a pullback.

1.0.3 S&P 500 SPDRs (SPY 30 min), Bearish Rising Wedge plus lots of negative divergences.

Zweig Breadth Thrust from Telechart, very overbought.

Before I finish this report, I’d like to show you a mail from uempel who has been a trader for more than 2 decades. I believe he’s trying to tell me, in a very diplomatic way, that I shouldn’t be too bearish. I think the mail is suitable for all the bears who visit my blog often. Sometimes, stop and take a rest could be the best strategy. Well, I’m not saying that he’s right about the current market. Just I respect whatever he says.

I lost some money yesterday, because I was fooling around with the SPX at 960 – I was expecting a small drop. The up-move caught me by surprise and I had to jump out in a hurry.

But it was entirely my mistake – I had not studied the charts without a bias, I was not neutral.

I’m not sure if you are familiar with P&F charts, but this chart shows two things quite clearly, 1.) the trend is to the upside and 2.) the next resistance levels are at 993...

And something else: a great EW analyst, an Australian by the name of Zoran Gayer, got completely messed up in 2003. He just did not notice the change of trend in March, failed to understand that the market was heading north again. For 3 years he kept on making bearish calls. There is also a tragic aspect to the story: he died in 2006. You can read all his posts in the archives at Safehaven com, search for Zoran Gayer. It’s worthwhile taking a look at them, because they are really good charts and what he writes makes sense. But Zoran was wearing blinders.

Why am I writing this: the lack of enthusiasm for this rally will propel it to the upside. The SPX could easily be 150 points higher in a few months time.

I shall be going to my mountain house for a few days. No internet connection there, I shall do the lawn (no high-tech), plant some trees (I intend to plant many birches around the house) and last but not least: I want to forget my work and the market for a little while...