| Trend | Momentum | Comments - Sample for using the trend table. Warning: This is NOT a trading recommendation! | |

| Long-term | Down | Idea for trading intermediate-term under primary down trend. | |

| Intermediate | Up | Neutral | According to $NYA50R, the market might be topped. |

| Short-term | Up | Neutral |

| Report Focused On | Buyable dip or the market topped? |

| Today’s Summary | The 5th unfilled gap and negative divergences still are bulls’ major concern. Don’t chase high if tomorrow is up again. |

Today’s report is similar with yesterday's, so take the speculation with a grain of salt:

- Higher high again, but still failed to close above 875 and SPY formed a black candle which often means a reversal, so I still cannot rule out the possibility of a fake head.

- Should the market gaps down tomorrow, the gap may not be filled because the 3rd time is the charm. On Monday and Tuesday the market gapped down and rallied immediately, so I won’t expect the 3rd time is the same.

- SPY still has 5 unfilled gaps, so the 5th gap has a good chance to be filled in a very near term. Again, if the market gaps up tomorrow, don’t expect the 6th gap to be held.

- Intermediate-term, I still expect the market to seesaw. I don’t see much edge today for either bulls or bears. However, if the market goes up tomorrow, don’t chase high because several accurate signals will get overbought again, therefore the market may pullback on Monday.

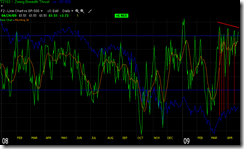

0.0.2 SPY Short-term Trading Signals. As aforementioned, it could be a fake head. Furthermore, the negative divergence is my biggest concern.

1.0.2 S&P 500 SPDRs (SPY 60 min), still 5 unfilled gap plus a couple of negative divergences, it looks very bearish to me.

1.0.3 S&P 500 SPDRs (SPY 30 min). The market has to resolve this puzzle, it could be a retest after the symmetrical triangle breakout, or a head and shoulders top. I don’t know.

Here are two interesting charts.

3.0.0 10Y T-Bill Yield, market could be topped. Please notice that the top given by this chart may be a month earlier. For the back test of this signal, please refer to 8.0.4 Market top/bottom by ROC30 of 10Y T-Bill Yield 2005-2008, 8.0.5 Market top/bottom by ROC30 of 10Y T-Bill Yield 2001-2004. Since 2001 this chart only gives one false signal in predicting a top. By the way, some readers may not understand the numbers preceding every of my charts. Let me explain one more time, all charts in my report come from my chart book at StockCharts.com. By the way, the click rate of my chart book has been a No 1 in StockCharts.com for the past several months, and about 6,000 readers read my market recap (including the Chinese version) on a daily basis. I am not bragging here, what I mean is that my market recap should have some credit. Well, maybe view it from a contrarian’s perspective could get a better results, LOL, but anyway, credit is a credit. Again, the market recap is different from giving the actual buy/sell signals, as this report tries to detect the trend change as early as possible, while for the real world trading, it’s better to let market go first. Therefore, sometimes this report may seems against the trend, so you should really pay attention to the trend table. For instance, now the intermediate term and short term are up, which means short selling must be taken with great caution unless bears have very convincing edges mentioned by the report. For more information, please refer to Sample for using the trend table.

5.0.2 S&P Sector Bullish Percent Index. Technology sector (BPINFO) and Consumer Discretionary (BPDISC) are almost 8 years high at this moment.