Today let us have a game analysis. Many people are feeling bullish although the market plunged, right? My observation is that, continuous selling-off rarely happens recently. After a day of selling off the next day the market usually goes up. It is especially true this week: selling off a day, dramatic rally the next day, another day of soaring up, a bigger diving down today. According to the observation, the market would go up violently, wouldn't it? Well, the Wall Street's game is that, the third time will be different. Tomorrow let's see if the Wall Street will give us a surprise.

1.0.2 S&P 500 Large Cap Index (Monthly). Yesterday I said today would be an important test for SPX monthly prediction. Yes, indeed two months down in a row! The good news is that we have already see two months down, then it will unclear if the market goes up or down in the August. So at least there is a possibility.

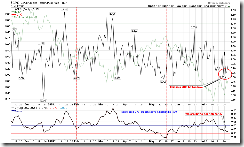

1.1.B QQQQ and VXN, 2.2.1 NYSE McClellan Oscillator, 2.8.1 CBOE Options Total Put/Call Ratio, these three indicators have been corrected in some sense. However, they are still close to the overbought region, so I will still consider the upside room is limited if there is no follow-through pullback tomorrow.

Especially the NAMO indicator on 1.1.B is very close to the overbought region. It would be safer if it dives down more.

2.8.1, the Bearish Area at the bottom has more serious problem. If CPC keeps going up, the Bearish Area will shrink, which means the market is actually going down from the top according to the history data. On the other hand, if CPC goes down the Bearish Are will enlarge, which means the market will reach the top soon. The key issue is that the market broke out on July 15th in the CPC Bearish Area, which causes the limited upside room. Anyway, this chart is a warning only and one should not act based on this chart solely.

1.1.8 PowerShares QQQ Trust (QQQQ 60 min). It looks like a Bearish Rising Wedge. Not good.

3.1.0 US Dollar Index (Daily). The US dollars seems unable to hold the key tests. Let's see how it goes tomorrow.

3.2.0 Japanese Yen (Daily). The Japanese Yen looks holding the key support. Together with 3.1.0, this is bearish to the stock market.

Conclusion: according to the Game Analysis, be ready to have a surprise from the Wall Street tomorrow. Even if there is no surprise, I still do not think the market can go up too far considered that the breadth is extremely close to the overbought region. Therefore my opinion is it might be better to do both long and short. My own strategy is to hold long, and do short-term short when the market breadth enters into overbought region again.

Very good analysis as usual. I have two questions (1) your use of $CPC..how does call options on hedge funds affect the number and your analysis and (2) would it be possible for you to forecast some numbers up or down?

ReplyDeleteThanks

2c

1. I mainly use CPCE (you'll see my unique way of using it when it signals. Check chart 2.8.0 if you like). For CPC yes, I know what you mean, but my conclusion was drawn from the chart past, it doesn't matter if it's CPC or something else as long as it shows repeatable patterns. Considering the underlying reasons why something work or does not work, sometimes is too complicated for me.

ReplyDelete2. I wish but I don't have the ability to forecast the numbers.

Thanks.