| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

|

SHORT-TERM: EXTREMELY LOW TICK READING GUARANTEES A LOWER LOW OR LOWER CLOSE AHEAD

A 1-2-3 trend change pattern is formed on SPY 60 min chart so at least short-term is not very bull friendly, especially now the ChiOsc is way too high, see dashed red lines, all had led to a pullback thereafter, and accordingly the rebound before the close can be seen as a back test of the Double Top neckline (see SPY 15 min chart at bottom) which means the market may continue pullback tomorrow. Overall, I think pullback to between Fib 23.6% at $115.15 and Double Top textbook target at $114.77 is quite likely.

Another not so bull friendly signal is an extremely low TICK was recorded today that some exchangers even reported it as a record low TICK readings. The chart below should be very clear that the red dashed lines overwhelm the green dashed lines which means an immediate lower low or lower close ahead is almost guaranteed.

On the other hand, bulls have 2 hopes, however after the 2nd and 3rd and 4th and (put whatever numbers you like here) thoughts, my guess is that they may not entirely bull friendly.

Since the rally started on 08/27, there’re total 3 big pullbacks each dropped 25 SPX points so the pullback could be over today. However, bears could argue that the 3rd time would be the charm therefore the pullback isn’t over yet.

Another bull’s argument is a back to back unfilled gap was formed today which theoretically should be filled within days, but the problem is bear too has a back to back unfilled gap that should be filled long time ago.

INTERMEDIATE-TERM: BEARISH BIASED, PIVOT DATE EITHER AROUND 10/22 OR 10/26 OR 11/04

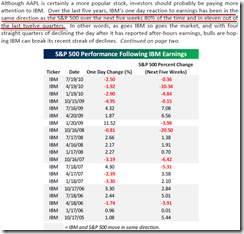

One more bad sign today as IBM dropped after ER which according to Bespoke means 80% chances that SPX will be red in 5 weeks.

The chart below is to follow up AAPL, although AAPL dropped after ER but unfortunately MACD is still way too stretched which probably means a top for QQQQ.

Besides, I wouldn’t hope much that AAPL could rebound huge because ChiOsc is way too high now, see what happened after the red dashed lines in the chart below.

Maintain the intermediate-term bearish view, the pivot date could be either around 10/22 or 10/26 or 11/04, see 10/15 Market Recap for more details. Below are summaries of all the arguments supporting my intermediate-term bearish view:

- As mentioned in 10/15 Market Recap, commercial (smart money) holds record high short positions against Nasdaq 100.

- As mentioned in 10/15 Market Recap, AAII bull ratio (4-week average) is way too bullish.

- As mentioned in 10/15 Market Recap, institution selling keeps increasing.

- As mentioned in 10/08 Market Recap, statistically, a strong off-season could mean a weaker earning season.

- As mentioned in 10/11 Market Recap, VIX:VXV is too low and statistically VIX at 1 month low going into October was not a good sign.

- As mentioned in 10/15 Market Recap, US$ may rebound which is not good for the broad market.

SEASONALITY: NO UPDATE

For October Seasonality chart please refer to 10/01 Market Recap.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

- The market appears a little stretched as lots of ETFs weekly %B are way too high.

- With possible Euro pullback, watch potential weakness on commodity related ETFs like XLE, XLB and XIU.TO.

| TREND | COMMENT | |

| QQQQ | *DOWN | |

| NDX Weekly | NDX to SPX ratio too high. %B too high. Neither had any edges though. | |

| IWM | *DOWN | |

| IWM Weekly | %B too high. | |

| CHINA | Rejected by downtrend line, watch… | |

| CHINA Weekly | Extremely high %B. | |

| EEM | *DOWN | |

| EEM Weekly | EEM to SPX ratio too high, %B too high. Neither had any edges though. | |

| XIU.TO | *DOWN | TOADV MA(10) too high. *Hollow red bar on trend line, rebound? |

| XIU.TO Weekly | Fib 61.8% plus %B too high with negative divergence. | |

| TLT | *UP | 1-2-3 trend change? So TLT could be in an intermediate-term downtrend. Be careful. |

| TLT Weekly | ||

| FXE | *DOWN | |

| FXE Weekly | Stalled at Fib confluences area, %B too high with negative divergence, too high above MA(40). | |

| GLD | *DOWN | |

| GLD Weekly | %B too high. | |

| GDX | DOWN | *On support, BPGDM sell signal though. |

| GDX Weekly | GDX to SPX ratio too high, %B too high with negative divergence. | |

| USO | *DOWN | *Breakdown below a consolidation area, bearish. |

| WTIC Weekly | ||

| XLE | *DOWN | |

| XLE Weekly | %B too high with negative divergence. | |

| XLF | *DOWN | |

| XLF Weekly | Head and Shoulders Top in the forming? | |

| IYR | DOWN | *Multiple reversal bars stalled under Rising Wedge resistance, not good. |

| IYR Weekly | Home builders are lagging. | |

| XLB | *DOWN | |

| XLB Weekly | %B too high with negative divergence. |

- Please make sure you understand how to use the table above. The purpose of this report is to provide info so contradictory signals are always presented.

- Position reported in short-term session of the table above is for short-term model only, I may or may not hold other positions which will not be disclosed.

- Conclusions can be confirmed endlessly, but trading wise, you have to take actions at certain risk level as soon as you feel the confirmation is enough. There’s no way for me to adapt to different risk levels therefore offer no trading signals will be given in this report except the mechanical signals such as SPY ST Model.

- * = New update; Blue Text = Link to a chart in my public chart list; UP/DOWN = Short-term trend; L A = Lateral Trend