SHORT-TERM: COULD BE GREEN THE NEXT WEEK BUT LIKELY LOWER LOW FIRST

75% to 81% chances a green week the next week, but 83% chances there’ll be a lower low first.

Therefore the normal pattern would go like below. Just beware, unlike my mostly precise evil plans in my Intra-day Comment, the daily evil plan is no more than a wishful thinking, perfectly designed for Cobra Impulse System, so concept only, doesn’t mean the bottom is 1220.

And so according to the evil plan above, if you have trapped longs, while there’s one night the next week, the futures, as well as the entire world, are deeply in red, you find very hard to sleep, and to make things worse, after a sharp gap down the next day, the market keeps selling off until you feel pain in your stomach, well, better don’t hit the sell button. The charts below are all my ultimate weapons for watching the oversold condition (those who followed me long enough should know that I don’t use oversold/overbought as title unless I’m 100% sure a reversal is coming, so those are by no means ordinary indicators), clearly we’re almost there now, so if there’s indeed a panic the next week, most likely it’s a perfect chances to be at least a temporary bull.

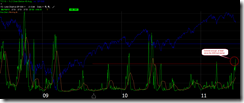

8.1.5 Normalized CPCE, too high.

Indicators at Extremes, this means that most of the Sentimentrader indicators are bullish now.

T2116, too many NYSE stocks are 2 std dev below MA(40).

T2122, too many NYSE stocks are at 4 weeks low.

INTERMEDIATE-TERM: STATISTICALLY BEARISH FOR THE NEXT 2 WEEKS

See 06/03 Market Outlook for more details.

SEASONALITY: BEARISH MONDAY AND FRIDAY

According to Stock Trader’s Almanac:

- Monday of Triple Witching Week, Down down 8 of last 13.

- June Triple Witching Day, Dow down 7 of last 12, average loss 0.5%.

Also see 06/01 Market Outlook for June day to day seasonality.

ACTIVE BULLISH SIGNALS:

- 8.1.5 Normalized CPCE: Too high, so bottomed?

ACTIVE BEARISH SIGNALS:

- N/A

ACTIVE BULLISH OUTLOOKS:

- 09/27 Market Recap: 9 POMO within 20 trading days means 14%+ up in 3 months.

- 06/10 Market Outlook: 75% to 81% chances a green next week.

ACTIVE BEARISH OUTLOOKS:

- 06/03 Market Outlook: IWM weekly Bearish Engulfing and SPY down 5 consecutive weeks were bearish for the next 3 weeks.

06/08 Market Outlook: The very first rebound most likely will fail.- 06/10 Market Outlook: 83% chances a lower low the next week.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST:

| ||||||||||||||||||||||||||||||||||||||||||||||||

|