Summary:

Could be a down day tomorrow.

| Trend | Momentum | Comments - Sample for using the trend table. | |

| Long-term | Up | ||

| Intermediate | Up | Neutral | |

| Short-term | Up | Neutral | |

| My Emotion | No idea | Neither believe this bull nor want to be a hero to short against it. |

I saw quite a few reasons arguing for a red close tomorrow although I’m not sure if the market would go to a new high first before attempting a pullback.

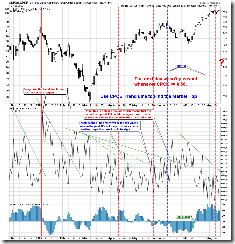

2.8.0 SPX:CPCE, CPCE < 0.56, counting the dashed vertical lines, very likely a red close tomorrow.

2.3.3 NYSE Total Volume, too low, which usually means a top. Take a look at the red dashed vertical lines, what happened the next day and thereafter?

2.3.4 Nasdaq Total Volume/NYSE Total Volume, this is a record high, look at the red dashed vertical lines as well, what happened the next day and thereafter?

Also the 2 comprehensive indicators from www.sentimentrader.com mentioned in yesterday’s report are still at an extreme level:

Smart Monday / Dumb Money Confidence, dumb money confidence too high.

Indicators at Extremes, which combines all the indicators on www.sentimentrader.com, the spread between the total number of bullish signals and the total number of bearish signals are still very large.

3.1.0 PowerShares DB US Dollar Index Bullish Fund (UUP Daily), hollow red bar usually leads to a reversal, so US$ could rebound tomorrow which might cause the stock market to pullback.

In addition I’d like to bring your attentions for the following 2 charts. They probably mean that the uptrend is weakening. I’ll keep watching on them and report to you anything suspicious.

7.1.0 Use n vs n Rule to Identify a Trend Change, the very first time, bears won unless bulls could push above SPX 1018 tomorrow. This of course doesn’t mean a top which usually requires several “n vs n”. Take a look at chart 8.0.3 Use n vs n Rule to Identify a Trend Change 2008 for the past examples then you will understand what I mean for several “n vs n” to form a top.

7.7.9 Russell 3000 Dominant Price-Volume Relationships, neither of the most recent huge up day was confirmed by a bullish price-volume relationships and there wasn’t a follow-through the next day either, so need to watch carefully, they may imply a little bit bigger pullback ahead.

Nice work Cobra. Thanks.

ReplyDeleteThe market will turn negative once all the pumpers have unloaded their shares to retailers, which is probably over by now given the low volume.

ReplyDeleteMarkets will make new highs. Watch out bears!

ReplyDeleteNice stats Cobra. I bought some more S+P puts today and it looks like they'll pay off immediately. I've seen a gazillion different sources mention August 14 as a key cycle/down date. XLF and GLD put in black (reversal?) bars today and XLF already put in a beautiful parabolic spike with a spike top and a doji thrown in for good measure last week; I just don't see how another rally can start from that pattern. US dollar is setting up for a big run.

ReplyDelete----Mr. Panic

Could the Nasdaq/NYSE volume ratio have been effected by the troubles at the NYSE exchange today? I saw a pop up alert on that from IB?

ReplyDeleteI don't see any offical report about NYSE being stopped, besides even it's true, I don't think for halting only a few minutes would make this huge differences.

ReplyDeleteLove this blog. Thanks for putting so much time and effort for the benefit of all, regardless if it agrees with our slope of hope ;-)

ReplyDeleteCobra,

ReplyDeleteI think there was a connectivity issue at the NYSE which affected trading for more than a couple of minutes (I got a respective feedback from a reader who stated that he had a connectivity issue for a couple of hours). Approximately 3 hours before the close NYSE Volume were only 16% of NYSE Volume the day before which would've been an all time low (always possible, but not very probable because NASDAQ volume came in almost unchanged in comparison to the session before).

So I'd take NYSE Total Volume on Thursday's session with a grain of salt.

Best,

Frank

http:/www.tradingtheodds.com

GReat work Cobra! Thanks

ReplyDeleteAs always Cobra your work stands out among the masses. This is one of the few sites I truly trust for trading information. Thank you for all the hard work you put in!

ReplyDeleteHey Cobra,

ReplyDeleteVery nice work, as always.

For the last chart, are you using Telechart to determine it, or are you doing it yourself?

TIA & Good luck!

Glad to see you are getting so many well deserved comments! You have been very accurate lately, nice work as always

ReplyDeleteGuys, thanks for all the praise, just hope that the market won't slap my face again today. :-)

ReplyDeleteDave, for the last chart, I use Telechart Easy Scan to get my data although Don Worden does report these data everyday.