Summary:

Simple list of some short-term "bear friendly" signals.

| Trend | Momentum | Comments - Sample for using the trend table. | |

| Long-term | Down | ||

| Intermediate | Up | Overbought | |

| Short-term | Up | Neutral |

Nothing new today, the same signals I mentioned yesterday which were my favorites in the PAST.

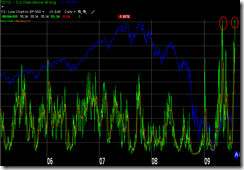

T2112 % of stocks trading 2 std dev above MA40 from Telechart, still overbought. Here’s a longer history chart, take a look to feel a little bit about how much higher is this new record high.

0.0.2 SPY Short-term Trading Signals, as mentioned yesterday, pay attention to volume which was decreased again. For up 4 days in a row while volume down 4 days in a row, the price-volume relationship is definitely bearish.

1.0.2 S&P 500 SPDRs (SPY 60 min), gaps, negative divergences, Bearish Rising Wedge, you name it. I see this chart as very bearish.

T2103 Zweig Breadth Thrust from Telechart, overbought.

T2122 4 Week New High/Low Ratio from Telechart, overbought, sill has some upside room left though.

The Aug seasonality from www.sentimentrader.com, I don’t see anything special for the first 9 trading days.

Do you compare SPX against US$? Some saying the lower US$ goes the higher market going. Is this true?

ReplyDeleteYes, it's true. Lower US$ means higher commodities also means carry trade (short US$ buy euro to invest in stock market).

ReplyDeleteCobra, Your T2112 chart is quite amazing, what could this be telling us. Also if you look at the nya200r chart it is at a new record also. Your thoughts ?

ReplyDeleteI have that chart here: http://stockcharts.com/def/servlet/Favorites.CServlet?obj=ID2393449&cmd=show[s152595461]&disp=P

ReplyDeleteJust I think it's still not high enough. Only above 90 could make me look this chart twice.

Cobra, 88.29 or 90 , whats the difference ? It's going up 2 pts a day so tomorrow maybe will be there.

ReplyDeleteWell, this market requires extremely extreme. All these charts are telling us this is a strong market, but due for a short-term pullback. When and how large the pullback will be? Unfortunately, these indicators cannot tell.

ReplyDeleteA crashing dollar means we Americans are all getting poorer. Period. I don't care what the stock market is doing. All inflation oriented instruments are forming very bullish patterns here. Maybe it's time to just buy oil and TIPS and hold for protection (and maybe a gun, too).

ReplyDelete"Well, this market requires extremely extreme. " Ya but the other side of this coin is that if we do go "extremely extreme", then everyone will be expecting a large pull back (just like the whole world knows this now (http://www.marketwatch.com/story/asian-shares-barely-moved-momentum-could-be-waning-2009-08-04)

ReplyDeleteSo it may not happen... that's the suck part about extreme... Just like the last H&S play... everyone knows about it and CNBC and marketwatch was all over it and then it never materialized... Everyone is expecting a large pull back after this extreme move from March, so it may not materialize either...

By the way, the only way I see that we going to get a large pull back is that it happen overnight where no one can get in... we get a 6% overnight drop and then a quick 4% in first 30 minutes of trade and the first switch hit and then another 10% drop in another 30 minutes... That's another way of not letting people get in on the pull back...

ReplyDeletedo you do any math.6% overnight drop.

ReplyDelete60 pt move on the spx.. Then a 4% move.... 40 pts up. Then 10 %Down 100 spx pts.

That would take a vix at 200... It would take an asteroid... Or you to take off the tinfoil hat.