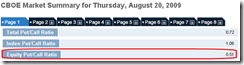

Well, wrong 2 days in a row, hopefully I could get the 3rd time charm: I expect a red close tomorrow because CPCE closed at 0.51 which is way too bullish, by counting the dashed vertical lines below, 11 out of 13 times recently when CPCE closed bellow 0.56, a red close next day.

Live Update

Thursday, August 20, 2009

Subscribe to:

Post Comments (Atom)

Disclaimer

The information contained on this website and from any communication related to the author’s blog and chartbook is for information purposes only. The chart analysis and the market recap do not hold out as providing any financial, legal, investment, or other advice. In addition, no suggestion or advice is offered regarding the nature, profitability, suitability, sustainability of any particular trading practice or investment strategy. The materials on this website do not constitute offer or advice and you should not rely on the information here to make or refrain from making any decision or take or refrain from taking any action. It is up to the visitors to make their own decisions, or to consult with a registered professional financial advisor.

This websites provides third-party websites for your convenience but the author does not endorse, approve, or certify the information on other websites, nor does the author take responsibility for a part or all materials on the third-party websites which are not maintained by the author.

This websites provides third-party websites for your convenience but the author does not endorse, approve, or certify the information on other websites, nor does the author take responsibility for a part or all materials on the third-party websites which are not maintained by the author.

happy birthday,cobra.thank you for your hard work

ReplyDeleteCobra, forget about TA... just buy the dip! gee... what the market has become? Any fall below 1% just buy, buy buy! you won't loss a dime that way... All indicator has render useless, the only indicator I've found work of late is just buy if we fall 1% or more...

ReplyDeleteHappy Birthday Cobra.

ReplyDeletehappy birthday cobra! do you expect a gap down in the morning?

ReplyDeleteHappy birthday Cobra! I really appreciate your work, your insight very much. Whenever you feel frustrated, just yell it out in HT, many many peple will come to support you.

ReplyDeleteThanks Cobra. 3rd time a charm..

ReplyDeleteHappy Birthday! Hehe...

ReplyDeleteThank you guys, now I feel much better!

ReplyDeleteHappy Birthday! you are the best!

ReplyDeleteHappy Birthday, Cobra!

ReplyDeleteHappy happy birthday!

ReplyDeleteYou are always the best no matter what happened!

Happy birthday!

ReplyDeleteIs there a place we can still see the inst.b.s chart?

Thank you!

Happy birthday, Cobra.

ReplyDeleteCobra,

ReplyDeleteYou've been wrong a lot more than 2 times in a row. You haven't been following the intermediate trend at all. you've been all caught up in day to day analysis, and not seeing bigger picture.

You're smart, but not trading properly.

HAPPY BIRTHDAY COBRA!

ReplyDeletewell done!!

ReplyDeleteCobra, how confident are you 1 to 10(red day tomorrow)?

ReplyDeletep.s Happy birthday!

Happy Birthday!

ReplyDeleteBest wishes!

to Cocameister,

ReplyDeleteif you think cobra is so wrong, I then have some questions for you:

1. why you still waste your time coming here?

2. how often do you make mistakes?

3. what's your intermediate 'trend'?

don't just point fingers.

hehe, looks like OE close will be at 99.xx :) --- bayliner1979

ReplyDeletehttp://www.hutong9.com/viewthread.php?tid=35927&page=94#pid773063

Bonny, I'll say 11/13 = 84% times tomorrow.

ReplyDeleteAnon at 6:41, I'll post the chart when I see necessary, right now no big changes. Inst acc > inst dist.

Two days in a row, the predictions went wrong :( Wish the market goes in to deep red to compensate both days.... Option expiry week is hard to predict. Good job, Cobra :)

ReplyDeletehappy birthday!!! Thanks for all the hard works!!!

ReplyDeleteHappy BDay Cobra.

ReplyDelete生日快樂

ReplyDeleteCobra - Happy Birthday. Your analysis is purely based on technicals and not influenced by anyone else. E.g. EW stated yesterday that the correction is over with 23.6 Fib retrace and you still stick your analysis. That's great and candid analysis based on your experience. Even the big guys make mistake and don't forget this is OE. Thus, Market maker decide most of the times where the market would end at Fridday EOD.

ReplyDeleteHere is one speculation that I have - no matter where market ends tomorrow, we would gap down "big" on coming Monday - just like this we gapped down this Monday - Let's how that comes good...

EW Guy..

Happy Birthday to you, Cobra. Appreciate your work and your sharing with me/us.

ReplyDeleteBest wishes and may you have many many more GREAT days.

Happy Birthday!!!

ReplyDeleteHappy Birthday, Cobra.

ReplyDeletehappy birthday.

ReplyDeleteHappy Bday! :P

ReplyDeleteHAPPY BIRTHDAY, COBRA.

ReplyDeletehappy birthday cobra

ReplyDeleteHappy Birthday, Cobra!!

ReplyDeletefeliz cumpleanos

ReplyDeleteIt's your birthday? It's your birthday!

ReplyDeletehttp://www.youtube.com/watch?v=1vXgpBVK24o

(44 seconds into it)

Hey Cobra,

ReplyDeleteMany happy returns of the day. May this year brings you the highest trading profit.

Keri

In response to Anonymous at 6:52 PM,

ReplyDelete1. The reason I come here? Well, Cobra used to be better at predicting market direction. In the bear market, overbought conditions would quickly lead to a pullback. Unfortunately, he has thought the same is true since March, but no no. In a BULL type market, overbought does not mean a pullback automatically. He must adjust his indicators depending on the underlying trend, which has been up for 5 months now.

2. I come here because I like the links on the right side of the page.

3. Yes, I have made some mistakes. Let me spell them out for you:

A. BRCD- bought around 3 in March and sold a little above 4 in early April as it struggled at the 200 day MA. It is now about $8 per share.

2. MOS- placed stop at 39.95 in April as this price represented break out of rising wedge, break below 50 day MA, and loss of previous price support. It promptly reversed and traded up to around 58, representing a false breakdown. Now trading for about 54.

3. EBS- bought it around 11 in April, stopped out below 10 in May, and then it broke out of downtrend and trades for 16.75 per share.

Those are my big mistakes...putting stops when the INTERMEDIATE trend was up. However, these mistakes have been counterbalanced by my other holdings that I put NO STOPS on:

AA- bought in March for 5.4

GE- bought in March for 6

RFMD- bought for 1.20

C- bought for 2.70

HGSI- bought for 1.68

LPX- 2.68

RIMM- 42.30

TSL- 11.48

XL- 5.82

X- 23.96

I will stop with the individual positions- too many others to list here

Also > 50-100% gains (multiple entries) on FAS, URE, SSO, UPRO, QLD, UYM

I think, these results, and just looking at a simple chart with moving averages, tells me that the intermediate trend is UP. All these other indicators are noise and cause PARALYSIS by ANALYSIS.

Cocameister, thanks for the update. And your adivces are well taken, I'll sure remember that. Although I've been saying I never trade against my indicators, so what you have said is not completely right. And as for the next day speculation, there're lots of very short-term traders need that, so I won't say my effort is usless. Well, again, thanks for the comments, hope I could be better in the near future.

ReplyDeleteCobra, you are a true gentleman!

ReplyDeleteHappy birthday!

and thank you!

springmt

Cobra,

ReplyDeleteNo need to apologize. You never post actual trades, so I have no idea if you are making money or not. But, I think that you do a very comprehensive job of summarizing so many indicators. And you were often right in 2008. I even referred a few of my friends to read your site. But, both of them came back and complained that following your suggestions would only cause one to lose money! And, there is nothing wrong with very short-term trading, but let's count the number of times in the past 5 months that you said "expect a pullback tomorrow" and how many times the market actually went up. That would be a very high percentage. There are bull market rules and bear market rules, but you don't differentiate the two. You kept pointing out the separation between NYSE advancing stocks and up volume, and then the monster rally off of 875 happened....relentlessly. Where did that indicator get any of us? It used to work in the downtrend, but not in the uptrend.

Happy birthday, you are my hero!!!!

ReplyDeletegua gua gua

Happy Birthday Cobra!!!

ReplyDeleteTo Cocameister, put a sock in it! You need to appreciate people who take the time to help others, if you want to complain then go pay for subscriptions and critizes them. thanks Cobra.

I like the kind of argument Cocameister made. I learned a lot from it.

ReplyDeleteThanks

All you wrote are very helpful, no matter it is wrong or correct finally.

ReplyDeleteThanks for your hard work!

Happy birthday Cobra!!!!

ReplyDeleteI guess I just posted something on the wrong thread. (Last thread)

-------Mr. Panic

Hi, guys, thank you thank you, I cannot say enough thank you to all of you. This sure will be the birthday I remember forever! Thanks again!

ReplyDeleteThanks for your work, Cobra, and happy birthday! You're one of the best at posting your analysis without too much editorial / bear-or-bull cheerleading. As for the rest of us (cocameister et al), we'd be fools to rely on other people to do our work for us. Do your own analysis people, then check it against Cobra's work and that of others to make sure you're not missing any interpretations of the market. If you lose money, it's on your own head, not Cobra's.

ReplyDeleteCobra, I appreciate your analysis, thank you for sharing it!

ReplyDeleteAnonymous (11:16 PM)-

ReplyDeleteI do my own work...obviously. I'm just annoyed that all you people bow to Cobra and thank him every single night without EVER providing any of your own analyses. There is rarely is disagreement or intelligent discussion about alternative possibilities. Clearly, there have been more profitable interpretations than Cobra's, but all anyone done is thank thank thank for excellent analyses.

Cocameister,

ReplyDeleteIf you are so correct on your analysis why don’t you put your analysis for short, medium and long term and let us see who accurate you are !!!

Pls, don’t show your past performance, there is no way to verify that!!

If you have guts put your for short, medium and long term analysis!!

Lately, I haven’t seen anybody analysis is accurate…

Cobra,

ReplyDeleteI just konw from others' posts that today is your birthday. Happy birthday to you! Thank you for all your efforts to keep this blog updated everyday. Thank you!

Anonymous (12:39 PM),

ReplyDeleteA. Get an ID instead of using anonymous

B. I will be happy to send you a screen capture of my portfolio to your private email so you can "verify" my results. I gave you very exact price points...I don't think I took the time to make anything up.

C. Short term: SPX in a symmetrical triangle formation. Gap up this morning. First resistance is 1018 (38.2% fib retrace of whole bear market). Next stop: 1026 at 70 week simple moving average. Measured move out of the triangle measures to 1050. I think we may get to 1050 in next few days, then likely consolidation. Then there will be MACD negative divergences, so will be cautious. Will examine how the weekly MACD looks. If no negative divergence, then I suspect with time, SPX can make it to the top trendline on my chart:

http://tinyurl.com/n9vs3l

This trendline also co-incides with about the 61.8% fib retrace of the whole bear market and also fulfills the target for the breakout of the huge inverted H&S with neckline at 956.

We'll see.