| ||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||

|

INTERMEDIATE-TERM: COULD BE A BIGGER CORRECTION BUT NOT SURE IF THERE’S A NEW HIGH FIRST

See 02/26 Market Recap, according to II Survey, since too many people are expecting a correction, so the market would rebound huge before a real correction kicks in. So far we’ve got the huge rebound but the question is how high the rebound could go?

About “how high the rebound could go”, the only clue I have is the time cycle. I’ve been mentioning the cycles a lot in recent reports, especially the very last cycle due date in chart 1.0.7 SPX Cycle Watch (Daily) (purple line), when I feel has the highest odds of being a turning point. The reasons are listed below.

Firstly, from the Important highs and lows Calendar, we can see there’re lots of important turning points happened on 03/06:

- 03/06/2009

- 03/08/2006

- 03/07/2005

- 03/05/2004

So according to the Gann Theory, the day around 03/06 is most likely to be a turning point.

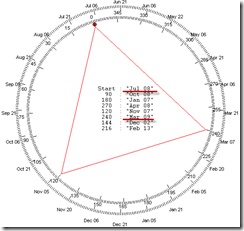

Now take a look at the Gann Emblem:

- The 360 degree from 03/06/2009 low is at 03/06/2010.

- The 240 degree from 07/08/2009 low is at 03/07/2010.

From the chart below we can see all the Gann Days marked by blue and red are all around some turning points which proves that Gann day has its merit. I logically believe such a turning effect could be doubled when the blue line meets with the red line around 03/06 again.

The Gann Emblem chart below illustrates how I get “the 240 degree from 07/08/2009 low is at 03/07/2010”. If you don’t understand, it’s OK, I just pretend to understand (so don’t ask me questions about it).

Also according to Gann Theory, from Solar Terms, 03/06 is around “awakening of insects” which also is a potential turning point.

Too complicated above, right? Well, what I tried to say is if the market rises to 03/06 then 03/06 could be a top while the market drops to 03/06 then 03/06 could be a bottom. If in the end, it proves that 03/06 is a top, then I expect a bigger correction to conform the past II Survey pattern (see 02/26 Market Recap for the chart). As for the question, how high the market could go before 03/06, I have no idea.

Still feel complicated? Trading actually is simple if you followed my SPY ST Model. Now it’s the time to set the stop loss to breakeven (see table above), then just sit and relax, simply let the market show us its real intentions.

SHORT-TERM: MIXED SIGNALS BUT I BELIEVE THE BEARISH SIGNAL WILL ACT FIRST

I’ve got 2 mixed signals for the short-term, one is bull friendly and the other is bear friendly. I tend to believe that the bear friendly signal will act first and if the pullback is not large then the bull friendly signal could still apply.

1.0.2 S&P 500 SPDRs (SPY 60 min), this one is for bulls, could be a Head and Shoulders Bottom in the forming. The text book target is 119.42.

2.3.4 Nasdaq Total Volume/NYSE Total Volume, this one is bear friendly, which unfortunately is very reliable. The ratio spike means that people are too bullish (not afraid of risk, since Nasdaq stocks are higher beta stocks) which usually means a market top.

STOCK SCREENER: For fun only, I may not actually trade the screeners. Since SPY ST Model is in BUY mode, only LONG candidates are listed. For back test details as well as how to confirm the entry and set stop loss please read HERE. Please make sure you understand the basic risk management HERE.

Since the intermediate-term direction is not clear, so no stock screeners from now on until the dust settles.