| ||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||

|

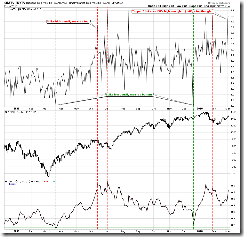

INTERMEDIATE-TERM: VERY CLOSE TO A TURNING POINT, NOT SURE IT’S A TOP OR BOTTOM THOUGH

See 03/01 Market Recap, there’re several cycles due this week or early next week, among them the 03/08 could be the most important one. The market rises into 03/08 then 03/08 could be a top while the market drops into 03/08 then 03/08 could be a bottom.

SHORT-TERM: COULD SEE A PULLBACK VERY SOON

I see three things against bulls today, so very short-term there could be a pullback. Besides, as mentioned in today’s After Bell Quick Summary, even the market rises again tomorrow, it’s very unlikely to rise big.

0.0.2 SPY Short-term Trading Signals, black bar (see red cycles), looks like all the next day was in red recently.

2.3.4 Nasdaq Total Volume/NYSE Total Volume, Nasdaq volume to NYSE volume ratio too high means people are too bullish therefore it usually means a top.

If you haven’t noticed this in the table above, then let me remind you here: 1.0.2 S&P 500 SPDRs (SPY 60 min) now has 14 unfilled gaps, it had maximum 15 unfilled gaps in the most bullish period of the last year; 1.1.0 Nasdaq Composite (Daily) now has 9 unfilled gaps, and it had maximum 9 unfilled gaps in the most bullish period of the last year. The question is whether now is more bullish than that of last year? Well, at least from the inflow liquidity (courtesy of stocktiming) chart below, the answer is no.

STOCK SCREENER: For fun only, I may not actually trade the screeners. Since SPY ST Model is in BUY mode, only LONG candidates are listed. For back test details as well as how to confirm the entry and set stop loss please read HERE. Please make sure you understand the basic risk management HERE.

Since the intermediate-term direction is not clear, so no stock screeners from now on until the dust settles.