| ||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||

|

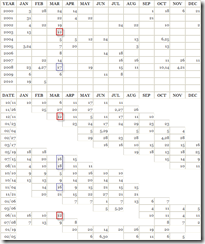

Please make sure you understand how to use the table above. The main purpose of this report is to provide information so contradictory signals are always presented. Make your own decision on which signals are to be used.

INTERMEDIATE-TERM: THE NEXT IMPORTANT DATE IS 03/12

See 03/05 Market Recap, originally I thought the market would pullback from 03/09 to 03/16, now it looks like the market may rise to 03/16 because not only is the next Monday the famous Bullish Monday but also according to the Stock Trader’s Almanac 2010, Monday before March Triple Witching, Dow Up 16 of Last 22. However, bear still has one hope, as there’re multiple Gann Days due tomorrow which could be a potential turning day. Pullback from 03/12 then the pullback could last until 03/16 the next important Gann Day.

SHORT-TERM: MORE TOPPING SIGNS

Statistically, the market keeps rising for lots of consecutive days means on a little bit longer than short-term it still will rise. However, see table above, there’re way too many topping signs so I still expect a pullback. To make things worse (well, who cares), we have yet another topping sign today, 0.0.3 SPX Intermediate-term Trading Signals, the CPCE MA(10) below is a little bit too low.

Below are the most recent AAII Survey, too few bears and too fast increasing bulls which is not a good trend. I’ll keep watching on this situation and report to you as soon as I see more extremes.

2.0.0 Volatility Index (Daily), open high close in read, a bearish reversal bar was formed today so VIX could pullback which is good for bulls.

STOCK SCREENER: For fun only, I may not actually trade the screeners. Since SPY ST Model is in BUY mode, only LONG candidates are listed. For back test details as well as how to confirm the entry and set stop loss please read HERE. Please make sure you understand the basic risk management HERE.

Since the intermediate-term direction is not clear, so no stock screeners from now on until the dust settles.