| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

*Please make sure you understand how to use the table above. The main purpose of this report is to provide information so contradictory signals are always presented.

SEASONALITY: THE LAST 3 TRADING DAYS OF MARCH ARE BEARISH WHILE APRIL 1ST IS VERY BULLISH

According to Stock Trader’s Almanac:

- The last trading day of March, Dow down 10 of Last 15.

- The first trading day in April, Dow up 12 of last 15.

- the last 3 trading days of March is bearish, see Trading Trends: Last Four Trading Days of March.

In fact for the recent 7 months, almost all the last 3 trading days were not so bull friendly.

CYCLE ANALYSIS: PULLBACK FROM 03/25, REBOUND ON 04/01 THEN PULLBACK TO 04/12?

Let me list all the important date first:

1.0.7 SPX Cycle Watch (Daily), potential cycle turn date are 03/31 and 04/01.

4.1.9 SPX Cycle Watch (Weekly), potential cycle turn week this week or the next week.

The most repeated Gann Days in April are 04/11, 04/14 and 04/15. Also I mentioned the 04/10 in the 03/22 Market Recap, it actually should be 04/12. It’s Fib 50% extension from 10/10/2002 low to 10/11/2007 high which according to the Gann Theory, is an very important point. So combine all those days together, looks like 04/12 to 04/15 are very important.

4.1.0 S&P 500 Large Cap Index (Weekly), see solid red lines, BPSPX too high means at most the SPX could rise for another week, it’ll then pullback at least for a week or two.

So to summarize above, considering the first 3 trading days of the next week are generally bearish while Thursday is bullish as mentioned above in the seasonality session, my guess is a Doji next week then SPX starts to pullback the next next week until around 04/12. Why couldn’t that SPX drop to 04/01 then rise to 04/12? Well, don’t forget 4.1.0 S&P 500 Large Cap Index (Weekly), the BPSPX is too high so SPX should pullback for a week or two which also conform with the chart 4.1.9 SPX Cycle Watch (Weekly).

INTERMEDIATE-TERM: EXPECT ROLLER COASTER AHEAD

Nothing new, according to the II Survey, too many people expected a correction, so the stock market should rise to a new high first before actually pulling back. Basically, my guess is that we’ll repeat the year 2004 roller coaster pattern. See 03/19 Market Recap for more details.

SHORT-TERM: EXPECT PULLBACK AS EARLY AS THE NEXT MONDAY

As mentioned in the Friday’s After Bell Quick Summary, QQQQ black bar means 74% chances a red day the next day.

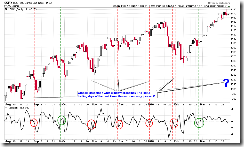

1.0.4 S&P 500 SPDRs (SPY 15 min), could be a Head and Shoulders Top breakdown while the Friday’s intraday rebound looks like a Bear Flag.

Rydex Enthusiasm Index, retailers buying dips were too aggressive.

% of Rydex Sector Assets Above MA(50), again retailers are too bullish.

The chart below is from Bespoke. This kind of no decline for more than 1% will not last forever, won it?

STOCK SCREENER: For fun only, I may not actually trade the screeners. Since SPY ST Model is in BUY mode, only LONG candidates are listed. For back test details as well as how to confirm the entry and set stop loss please read HERE. Please make sure you understand the basic risk management HERE.

Looks like it’s too late to long stocks now as the market is way too overbought. Waiting for a better chance.