| ||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||

|

*Please make sure you understand how to use the table above. The main purpose of this report is to provide information so contradictory signals are always presented.

*Skip the SEASONALITY and CYCLE ANALYSIS sessions below if you think they’re superstitious.

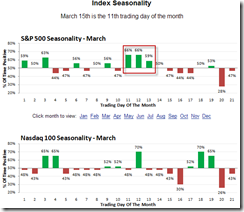

SEASONALITY: THE NEXT WEEK ARE GENERALLY BULLISH

According to Stock Trader’s Almanac: Monday before March Triple Witching, Dow Up 16 of Last 22. March Triple Witching Day however is 50-50.

According to Sentimentrader: The first 3 days of the next week are bullish.

According to Bespoke: SPX March Expiration weeks are generally bullish.

CYCLE ANALYSIS: MOON, CYCLES AND GANN DAYS ALL MEET NEXT WEEK, LOOKS LIKE A CYCLE TOP

This week’s Gann Day and cycles turn date worked miserably, however they’re not over yet, reasons:

- Cycle usually have several days error. In 03/11 Market Recap, I said 03/12 Gann Day could be a turning point, at least now cannot say it’s failed because on Friday the SPY formed a potential reversal bar so it could reverse down the next week.

- There’re still lots of Gann Days due next week, plus the New Moon and FOMC and Triple Witching, all could be a potential turning point.

1.0.7 SPX Cycle Watch (Daily), this is an improved version. The major changes are the cycle tools are now applying only on movements that are larger than 6.5%. In this way, the smaller whipsaws are eliminated. I believe this can make the cycle prediction work better. The chart below has removed all the other cycles that are not related to nowadays so that you can see clearly that there’re 2 cycles due this week and the next week. They both look like a top.

The chart below is the Calendar Day based cycle (since some people don’t believe trading day based cycles), the results are almost identical to that of chart 1.0.7 SPX Cycle Watch (Daily), if not better. Noticed that the rebound since 02/05 contains 2 waves, each so far lasted 17 calendar days with the same magnitude around 67.28. This complies with the Elliott Wave A = C.

1.0.8 SPX Cycle Watch (Moon Phases), the New Moon is on the next Monday. This time it’s less ambiguous than that of the last two times, it clearly argues for a top for now, unless a big big down gap open the next Monday.

03/16, 03/17, 03/18 the next week are all Gann Days, so the market could turn down on those days.

To summarize above, from the cycle point of view, chances are good that the next week could be a top of some kind. If the cycle due date on chart 1.0.7 SPX Cycle Watch (Daily) is proven to be true, then the pullback could be no less than 6.5%.

INTERMEDIATE-TERM: EXPECT CORRECTION TO CONFORM THE PAST II PATTERN NOT SURE WHEN IT WILL START

As for the intermediate-term forecast, still according to the past II pattern (see red lines), since too many people were expecting a correction, the market should rebound huge even to a new high before a real correction kicks in. So far, the huge rebound and the new high have conformed what the past II pattern says. Now the question is that if indeed there is a big correction ahead? Overall, I believe there’ll be a big correction ahead, just now I don’t know when it’ll happen.

Two additional reasons to expect a correction:

From the SPX longer history chart, the current resistance area is historically very important, so should not easily be broken through. Especially since the NYHILO (10 day MA of Record High Percent Index) above is too high now. There’re only 3 times this happened before, every time the pullback happened thereafter was not small. By the way, see red cycle, I’m expecting the market to repeat what happened in year 2004.

Options Speculation Index, way too high (means too much call buying and put selling). The last time this high was before the big correction in January. This time it’s even higher than that of January.

The charts below show a little bit non confirmations, not necessarily bearish since as time passes by the problem may be fixed eventually. Just want your attention to them. Also in the table above, I added an “ATTENTION” row to list all those need further attentions for your conveniences.

1.2.0 INDU Leads Market, non confirmation among INDU, TRAN, SPX and CRB.

1.1.0 Nasdaq Composite (Daily), non confirmation between COMPQ and SOX.

SHORT-TERM: COULD SEE A PULLBACK SOON

Still expect a short-term pullback. See table above for reasons, there’re too many of them.

0.0.2 SPY Short-term Trading Signals, for the 3rd time a black bar (Open > Close) was formed. It however failed to work the last 2 times. The question now is if the 3rd time is the charm?

The chart below shows what happened in the past when a black bar was formed on the QQQQ daily chart.

1.0.3 S&P 500 SPDRs (SPY 30 min), too much negative divergence.

STOCK SCREENER: For fun only, I may not actually trade the screeners. Since SPY ST Model is in BUY mode, only LONG candidates are listed. For back test details as well as how to confirm the entry and set stop loss please read HERE. Please make sure you understand the basic risk management HERE.

Since the intermediate-term direction is not clear, so no stock screeners from now on until the dust settles.