| ||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||

|

*Please make sure you understand how to use the table above. The main purpose of this report is to provide information so contradictory signals are always presented.

*Skip the SEASONALITY and CYCLE ANALYSIS sessions below if you think they’re superstitious.

SEASONALITY: THE FIRST HALF OF THE WEEK IS GENERALLY BULLISH

See 03/12 Market Recap for details.

CYCLE ANALYSIS: EXPECT A CYCLE TOP WITHIN THIS WEEK

See 03/12 Market Recap for details.

The cycles mentioned yesterday, still valid and look like a top.

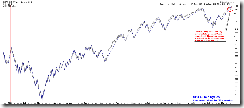

1.0.7 SPX Cycle Watch (Daily). The chart below has removed all other cycles that are not related to nowadays for cleaner views.

1.0.9 SPX Cycle Watch (60 min). The chart below has removed all other cycles that are not related to nowadays for cleaner views.

INTERMEDIATE-TERM: EXPECT CORRECTION TO CONFORM THE PAST II PATTERN, NOT SURE WHEN IT STARTS

See 03/12 Market Recap for details.

SHORT-TERM: COULD BE A LITTLE WEAKNESS TOMORROW MORNING

Bears are not over yet (well, I’m just murmuring).

- As mentioned above, the cycles are till valid and they all look like a top.

- The Gann Day due is 03/16, 03/17 and 03/18, so today is just a beginning. See 03/12 Market Recap for details.

- Seasonality wise, tomorrow is the last bullish day in March. Also see 03/12 Market Recap.

- As mentioned yesterday QQQQ black bar confirmed by a red bar the next day doesn’t mean an immediate top, see blue cycles, so far the current pattern conforms the past pattern, so again not over yet, still a top could be very close.

1.0.3 S&P 500 SPDRs (SPY 30 min), ChiOsc is a little bit too high plus the VIX rose sharply before the close could mean a gap down open tomorrow morning, so expect a little weakness at least tomorrow morning.

My amateur understanding of the Gann theory, for fun only. Use 02/05 low as the start point to calculate the Gann Square of Nine, SPX stopped right at 315 degree strong resistance today, plus as above mentioned the 03/16, 03/17 and 03/18 are all Gann Days (potential turning day), so according to the Gann theory, when both price and time confirm each other, it could be a turning point right here. I’m not convinced by this theory but I’m learning, maybe it works, then you’ll see another tool I’m using for my daily recap. Well, we’ll see.

STOCK SCREENER: For fun only, I may not actually trade the screeners. Since SPY ST Model is in BUY mode, only LONG candidates are listed. For back test details as well as how to confirm the entry and set stop loss please read HERE. Please make sure you understand the basic risk management HERE.

Looks like it’s too late to long stocks now as the market is way too overbought. Waiting for a better chance.