Summary:

Despite very bullish seasonality, the market may not be able to go up much because there're too few bears.

Expect short-term pullback soon.

| TREND | MOMENTUM | EMOTION | COMMENT - Sample for using the trend table. | |

| Long-term | Up | Disbelieve | ||

| Intermediate | Down | Neutral | ||

| Short-term | Up | Neutral | ||

| SPY SETUP | ENTRY DATE | INSTRUCTION | STOP LOSS | Mechanic trading signals for reference only. Back tested since 2002. |

| ST Model | 12/10 L |

| Breakeven | |

| Reversal Bar | 12/10 L |

| Breakeven |

|

| NYMO Sell |

| |||

| VIX ENV | ||||

Nothing new, for details please see 12/14/2009 Market Recap, very bullish seasonality for the following 4 weeks. However, today’s Investor's Intelligence Sentiment Survey still shows too few bears and according to the statistics from www.bespokepremium.com, that usually means not much upside ahead.

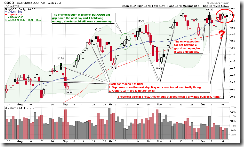

SHORT-TERM: EXPECT PULLBACK SOON

Here and there I’ve mentioned all the reasons for expecting a short-term pullback. Just put all them together here for you conveniences.

1.1.3 QQQQ Short-term Trading Signals, black bar means gap down open tomorrow (may not close in red though) and not far away from a short-term top.

Rydex Bull/Bear RSI Spread which is the differences between Rydex bullish fund inflow and bearish fund inflow. It had a dramatic changes yesterday. Now it looks like a top instead of a bottom. The today’s data is not available until mid night so I don’t know yet. If it has another dramatic change (say, aruges for a bottom) again then I’ll let you know first thing tomorrow morning. For now,let's just believe a top is very close。

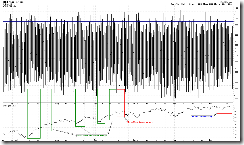

Longest streaks without -1000 tick?, I posted here in my blog but not in my forum, so have to mention it again. Days with tick –1000 normally should be up huge, but this time the market went nowhere. I think it’s due to a huge limit sell order above. It has no urgency to sell therefore we didn’t see any –1000 tick but certainly the market cannot go up either. This may not be a bearish sign. The key is the reason behind this huge limit sell order: whether it sells for bonus or for protecting it’s stop loss above, makes huge differences.

INTERESTING CHARTS: NONE