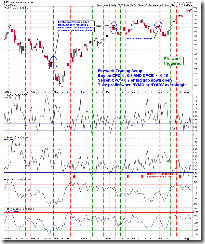

I expect a down day Monday because CPCE closed at 0.49. This is way too bullish.

The following chart illustrates what had happened whenever CPCE was less than 0.56 (counting dashed red and blue lines). Well, ignore the today’s reading for now as this is a long time known problem: the correct readings of CPCE and CPCI are only available after 7:40pm ET.

In case someone asks, yes, the firework is still on, it doesn’t matter what the CPCE readings are. Once the setup is triggered it remains on until either one of its close conditions is met.

PS. Q&A about my “confusing” CPC/CPCE rules:

Janet said... Cobra, which is more reliable CPCE or CPC?

August 7, 2009 6:11 PM Cobra said... CPCE is valid only for the next day. CPC firework setup could last for days. So for the next day, CPCE has higher priority. For example today, CPC < 0.8 which means 78% chances a green close Monday, but since CPCE < 0.56, so we should listen to CPCE instead of CPC. Of course, there's no 100% correct indicator. I found these rules, they worked pretty well in the past, but there's no way to know if they work in the future or not. I will simply use them until they're proved to be invalid.

thanks cobra!

ReplyDeleteCobra, which is more reliable CPCE or CPC?

ReplyDeleteCPCE is valid only for the next day. CPC firework setup could last for days. So for the next day, CPCE has higher priority. For example today, CPC < 0.8 which means 78% chances a green close Monday, but since CPCE < 0.56, so we should listen to CPCE instead of CPC. Of course, there's no 100% correct indicator. I found these rules, they worked pretty well in the past, but there's no way to know if they work in the future or not. I will simply use them until they're proved to be invalid.

ReplyDeletecan we get some firework into the downside please?

ReplyDeletewait so why would you be expecting a down day ? Doesn't the fireworks setup trump the CPCE data? Which takes priority? Thanks.

ReplyDeleteThanks Cobra.

ReplyDeletegordongecko, I think I've answered this question in "PS". Bascially, CPCE has higher priority but it just for the next day.

ReplyDeleteOn friday CPCE updates early,

ReplyDeletehttp://stockcharts.com/h-sc/ui?s=$CPCE&p=D&yr=0&mn=10&dy=0&id=p46576004728

Thanks. Indeed.

ReplyDeleteOh sorry, I must be tired and didn't know the CPC indicator was the same as the fireworks setup... now it makes sense. Thanks!

ReplyDeletethx, ding

ReplyDeletecopied from page 1 of Dr Joe

ReplyDeletehttp://stockcharts.com/def/servlet/Favorites.CServlet?obj=ID648573&cmd=show[s143363467]&disp=O

8-5-09 Three out of four major indexes are sitting very near their 38.2% retracement ratios. IF, and I repeat 'IF' this level holds, we're in for one heck of a drop. But a break to UP side could mean higher.

http://img21.imageshack.us/img21/8045/importantfibs.png

Hello Cobra,...

ReplyDeleteTues 08-11 is my next 3 wk cycle (likely pivot date). I am biased for a move down on Monday into a LOW on Tuesday,...with a possible higher close on Tues. I would view the 08-11 pivot as a likely tun UP from a Low on that day.

Looking ahead,..my next 3 wk cycle (likely pivot) date is a week later on Tues 08-18. No

idea what to expect at this time, will await whatever direction we take into the 08-18 date and expect a reversal.

Have a good weekend. Regards, Jim P.

I just went 100% short at 1014 on the S&P today. I believe all of next week will be down and a crash will occur on Friday. I believe that the "needle that pops this bubble" will be the major disappointing 30 yr bond auction.

ReplyDeleteTo learn more about the treasury bond auctions go read this article by Tyler Durden at http://www.zerohedge.com/article/guest-post-grand-unified-theory-market-manipulation.

This may very well be the top for the year? I'm expecting it to go down for the next 2 weeks and then turn back up around option expiration on the 20th, 21st, or maybe on Monday the 24th. This will be wave "A" down, then wave "B" back up.

Finally, around the middle of September (or earlier) Wave "C" down will start... that's when all the fun begins!

Dan Black

P.S. everyone...

ReplyDeleteMonday the 10th is my birthday. And my wish is a (oh... I can't tell you, or it won't happen), but I think you know what it. If the market is an elevator, then "Basement Floor Please"!

Dan Black

Dan, haha, you're so cute. Happy Birthday!

ReplyDeleteThis market should pullback. It would not be healthy to keep going above 1018 without at least a 3-5% correction (990-961).

ReplyDeleteA straight up run to 1040 would only be met with a lot of selling.

Food for thought.

S&P now 16% above the 200 sma. Historical highs are a bit over 20%. At this time 20% is about 1050+/-.

That dont mean we go up or down, but when S&P is 20% above 200 sma, watch for a final top.

http://stockcharts.com/def/servlet/Favorites.CServlet?obj=ID3449922&cmd=show&disp=o

Jman, thanks!

ReplyDeleteJim, is this what your cycles looks like:

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&b=9&g=0&id=p34517688358&a=174962097

S&P will no longer close below 1000.

ReplyDeleteThanks Cobra for working up a chart with my 3 wk cycle turn dates (four consurrent cycles, separated by pivots each spaced 13 mkt days apart). Very much appreciated.

ReplyDeleteAlthough these are "static counts", I can project them ahead and come up with likely windows for turns. Although these dates are not indicative of whether we will see a High or a Low, these likely pivot dates are a handy tool, especially when combined with other indicators, ..etc. Thanks again.

Future (likely pivot dates) include:

Tue 08-11, Tue 08-18, Fri 08-21, and Wed 08-26.

Also,..worth noting here, ....the AROON 14 Oscillator on $CPCE (CBOE EQUITY P/C Ratio) is at the "Market TOP" threshold...on the following link(s),..once open,..just click on to expand chart,..and then go to lower plot. This suggests we are AT,... or WITHIN a few days of,.. a likely TOP.

I find this AROON 14 OSC on $CPCE to be a handy tool,..this is a live link (not by me,..someone else's work),...updates continuously through the day,..and last fix is at 7pm,...when after hours trading is over,..etc.

http://stockcharts.com/c-sc/sc?s=$CPCE&p=D&yr=1&mn=0&dy=0&i=p44037532917&a=115818118&r=3214

or..

http://stockcharts.com/c-sc/sc?s=$CPCE&p=D&yr=1&mn=0&dy=0&i=p36774262940&a=115818118&r=4668

Have a good weekend.

Regards, Jim P.

Hey Cobra,

ReplyDeleteHave a look at this study. it shows the 21MA hitting multi year lows (i did not take into account yesterday, yet). The interesting thing is while the probability is indeed negative for the ST, it can also be BULLLISH! what is most suprising, is that it has long term BULLISH implications. I think this may simply be one of those fun with numbers cases, where different threshold values may show different results.

http://smallfishbigodds.blogspot.com/2009/08/equity-putcall-everyone-winner.html

Hi Cobra, thanks for all the posts.

ReplyDeleteAlso thankyou Jim for all the insights and references you have provided with the cycle analysis.

Happy Birthday Dan.Have a good one. I too hope you get your wish. (whatever that might be :)

In case you havent seen this, you might be interested in the post on unbiased trading from Merriman.

http://unbiasedtrading.blogspot.com/2009/08/big-moves-coming-next-2-weeks-in.html

have a nice weekend everyone.

Mr. Hoof

So what is Merriman saying? Will there be a big downturn?

ReplyDeleteAccording to this site, the Jupiter sun opposition on the 14th is supposed to tank the markets just like black monday.

http://youluckyfish.com/the-coming-stock-market-crash.html

Scott Redler, of T3Live.com, is a technical strategist who watches the market's short term moves. He said the S&P 500 hit an important level Friday, 1015.

ReplyDelete"The 1015 was the 38.2 percent retracement that a lot of technicians have been watching. That's an area that institutions sell," he said.

Redler said he believes the stock market's gains are now limited before it has a 10 to 15 percent retracement, and that it may have reached its highs for the summer.

"It could be that we've built ins a short term summer top, as we approach a seasonally soft time for stocks," he said.

The next area of resistance would be 1015, and that level could take the S&Ps to 1040, he said. If stocks decline, the support level for the S&P is 1000, a key psychological level.

http://www.cnbc.com/id/32337268

the bullish trend seems strong, this chart is suggesting a hope for bears. time will tell... http://stockcharts.com/h-sc/ui?s=$RHSPX&p=D&yr=3&mn=0&dy=0&id=p15353107966

ReplyDeleteWe are at the point of recognition. XLF and FAS have gone parabolic into their Friday highs and have reversed. BAC actually reversed and went negative by the close, C nearly did and GS was down all day. This just reminds me of Sept 15 last year when the $BKX put in a similar pattern by acting out a mini melt-up that exceeded the spike high from a few months earlier. The next day the $BKX had a big down day that took out more than just the previous day's gains and embarked on its mini-meltdown into November. Judging from the psychological whipping I took from Friday's action, I can imagine the bulls conversely are panicking into the market before it pulls away in its "breakout" after that stellar jobs report which was heavily influenced by auto plants restarting production.

ReplyDeleteAAII bulls was 50% last week but the euphoria from the job's report and its action on the stock market makes me think we could get a huge spike in bullishness next week. As mentioned earlier, the Daily Sentiment Index is already back to October 2007 levels of bullishness.

----Mr. Panic

Cobra,

ReplyDeleteFrom a historic standpoint what happens on the day after a crash? Does it usually continue down, or is there a bounce back up? Do you have the ability to look at previous crashes, and the days after? If you have time, please let me know.

Thanks,

Dan Black

dan (at) danblack (dot) com

P.S. Thanks for the birthday wish... you know what it is. (And thanks Mr. Hoof too).

P.S.S. Mr. Panic. I lost on those both FAZ and FAS several times. I'll never buy calls on either one anymore. The only way to succeed in to always by puts. If you think the market (financials) is going up, then by puts on the FAZ, and when you think it's going down by puts on FAS. Never buy calls on either, as they are both designed to go to zero over time.

Dan Black,

ReplyDeleteI don't own options; I actually buy the shares (of FAZ at least). I was going to send you an e-mail; But I wish you a happy birthday. My birthday was on July 25th so I feel cosmetically intertwined with the crash/ the solar eclipse etc. I found an interesting web-site a couple of days ago while perusing the SKF board. www.thecelestialwheel.com It has some interesting predictions for the upcoming month starting August 7th. This guy is coming from an Indian/ Vedic(?)Moon astrology approach.

Anyway, we're still in the Puetz crash window. The extension of this rally has only marginalized all the Puetz enthusiasts, and others like Mahendra Prophecy and judging by the euphoria of the bulls, I don't think anyone would listen anyway ala Spring 2000. Notice CNBC doesn't put Charles Biderman on anymore; he was pretty much absent back in 2000 too when his liquidity models were flashing major sell signals.

----Mr. Panic

You are welcome Mr. Hoof for the mention of cycle methods,..glad you find it worthwhile.

ReplyDeleteHave a good week ahead.

And Dan Black,..have a nice B-Day. I dropped you an email this morning.

And Mr Panic,..if you look at Ian's blog (Cobra now has it on blogroll sidebar),..and go to archives (previous posts) on Ian's blog,...you will find info on Vedic Astrology, Crash Windows,..Steve Peutz,.and Days of the Mother Divine,..etc,.etc. Lots of interesting reading:

http://timeandcycles.blogspot.com/

Regards, Jim P.

Dan, when market crashed, it kept dropping, that's all I saw from the past.

ReplyDeleteSmall fish, thanks for the info. Just for put/call ratio, I might not do back test like that unless I normalize it because in different period, the extreme value of put/call ratio is different. For example 0.64 for us now maybe extreme but it could be nothing in the past.

ReplyDeleteGood point cobra, C-PC and E-PC are similar to VIX in that way.

ReplyDeleteThe study shows results from 2002 to present. generally, lows of that period have been around .60 area. Given that we are approaching that area once more, it is probably not a bad idea to take note - however we could definitely we moving back to pre 2000, where it was rate to see a reading above .60.

I may try to see if i can come up with something that takes into account the recent average range.