| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

*Please make sure you understand how to use the table above. The main purpose of this report is to provide information so contradictory signals are always presented.

*DTFMS = Dual Time Frame Momentum Strategy. The signal is given when both weekly and daily STO have the same buy/sell signals. Use it as a filter, don’t trade directly.

SEASONALITY: WEEK AFTER JUNE TRIPLE WITCHING WAS BEARISH

See 06/18 Market Recap for more details.

INTERMEDIATE-TERM: INITIAL REBOUND TARGET AROUND 1150 AND TIME TARGET AROUND 06/24

See 06/14 Market Recap for more details.

SHORT-TERM: A LITTLE LITTLE LITTLE BULLISH BIASED TOMORROW

Nothing to say today, 4 reversal bars in a row, the SPY daily chart doesn’t look good. However as mentioned in today’s After Bell Quick Summary, for a Bearish Engulfing pattern like today, there’re only 15% chances a red day the next day since 2002. So very short-term is not very bearish.

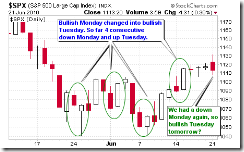

The chart below is another reason that we could see a green day tomorrow, for fun only. Tomorrow is the Tuesday which is well known as the turnaround Tuesday. Interestingly, for the past 4 weeks, we had consecutive red Monday then green Tuesday. We had a red Monday today, so a green Tuesday tomorrow again? We’ll see.

By the way, from some questions raised in my forum, I see some misunderstandings about the SPY ST Model’s buy mode. I’ve explained a little in the table above: Buy mode is just the primary signal. You can long on the primary buy signal but it’s not as safe as the the secondary buy signal. The chart below is the back test summary of the current on going SPY ST Model improving project, the 81% winning rate only applies when you follow the the secondary signal not the primary signal.