| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

*Please make sure you understand how to use the table above. The main purpose of this report is to provide information so contradictory signals are always presented.

*DTFMS = Dual Time Frame Momentum Strategy. The signal is given when both weekly and daily STO have the same buy/sell signals. Use it as a filter, don’t trade directly.

SEASONALITY: A LITTLE BIT BULLISH ON JUNE TRIPLE WITCHING WEEK

According to Stock Trader’s Almanac:

- June Triple Witching week, Dow up 5 straight years 2003 – 2007, down big in 2008, off 3.8%.

- June Triple Witching day, Dow up 4 of last 6, down big in 2008, off 1.8%.

INTERMEDIATE-TERM: NO BIG PULLBACKS AHEAD THEN THE MARKET HAS BOTTOMED

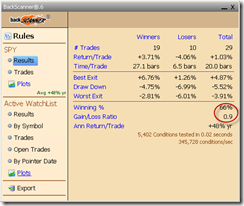

Bottomed? Hmm, I’ve been asking the same question for quite a time, now my most recent answer (subject to changes at anytime of course) is: Maybe, as long as there’s no big down day the next week. The back test (since year 2000) below is part of an ongoing project for improving the SPY ST Model (I believe you should be very satisfied with the current SPY ST Model now, but, yes, I’ve got better idea to improve it!):

- Buy at Friday’s close.

- Stop loss below 05/25 low.

- Move the stop loss to breakeven as soon as the current bar low is above the entry price.

If only you follow the 3 steps above the winning rate would be 66%. I don’t mean it’s a good trade though, because the Gain/Loss Ratio is only 0.9, not worth trading on it. The purpose I mention this setup is to say that at least bulls now have chances. From the past winning pattern of this setup, it looks to me as long as there’s no big down day the next week, then chances are very good that the market has bottomed. If we see a big down day the next week, then probably this is only a rebound, however, bulls who are already above water this Friday should have chances to escape unharmed.

6.4.1b Extreme NYADV Readings Watch, the very unique thing on the Thursday’s big rally was that NYADV reached an extremely high level which meant that the breath was very strong. See dashed red lines, such extremely high NYADV reading usually means a down day the next day. However, instead, we had green day again on Friday, which means, well, see green dashed lines.

The chart below has eliminated all the red dashed lines so that you can see clearly what happened after the green dashed line (I’ll explain the red arrows later in the short-term session which means very likely we’ll see a red Monday). Strong up breadth with the next day follow-through, it dose look that the market may keep rising thereafter, doesn’t it?

1.0.0 S&P 500 SPDRs (SPY 60 min), I’ve mentioned this in the Friday’s After Bell Quick Summary. I believe the 3rd time will be the charm so I’ve upgraded the short-term in the table above to up from down.

4.1.0 S&P 500 Large Cap Index (Weekly), the STO above and the NYSI STO below both are on buy signals now, looks promising.

So to summarize above, the bulls have hopes. There’re still some puzzles though, and that’s why I’m not very sure if indeed the market has bottomed.

- I’ve been mentioning this many times: no capitulation volume and NYMO missing positive divergence (see 06/09 Market Recap for more details).

- The 06/11 to 06/14 time window (See 06/04 Market Recap for more details) looks like a cycle top.

- 8.0.4 Use n vs n Rule to Identify a Trend Change, bulls have spent 4 days but still couldn’t beat the bears 2 days progress which according to the N vs N rule, this still is a sellable bounce. (One funny thing I’ve noticed recently though, every time I mentioned this chart saying bull or bear won then the next day the market would slap me in the face directly. So if the same funny thing happens again, we should see a huge rally on Monday. Well, let’s see.)

Combining all above, if all the signals are proven to be true eventually, then the most logic explanation is that the market could rebound for a few days but the sell off isn’t over yet. However since the 3 bear puzzles mentioned above are not very reliable, therefore, as I said above, all I can say are that bulls have hopes.

SHORT-TERM: COULD BE A RED MONDAY

For 2 reasons, we could see a red Monday. As mentioned in the intermediate-term session above, as long as it’s not a big red, then bulls should be OK.

The very unique thing on Friday was although the SPX closed in green but 0.2.1 10Y T-Bill Yield dropped more than 3%. This is not a good sign because the debt market usually leads the stock market. The back test (since year 2000) below at least argues that there’re 71% chances we’ll see a red Monday.

6.4.1b Extreme NYADV Readings Watch, I’ve mentioned this in the intermediate-term session above, see red arrows, it also argues for a red Monday.