| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

*Please make sure you understand how to use the table above. The main purpose of this report is to provide information so contradictory signals are always presented.

*DTFMS = Dual Time Frame Momentum Strategy. The signal is given when both weekly and daily STO have the same buy/sell signals. Use it as a filter, don’t trade directly.

SEASONALITY: WEEK AFTER JUNE TRIPLE WITCHING WAS BEARISH

See 06/18 Market Recap for more details.

INTERMEDIATE-TERM: INITIAL REBOUND TARGET AROUND 1150 AND TIME TARGET AROUND 06/24

See 06/14 Market Recap for more details.

SHORT-TERM: COULD BE AT LEAST ONE SMALL LEG DOWN TOMORROW

No good news today, as mentioned in the After Bell Quick Summary, could be a Bear Flag in the forming in chart 1.0.0 S&P 500 SPDRs (SPY 60 min), which usually means one more leg down at least. Another way to read the chart is to take a look at what happened in the past after so many consecutive red bars (6 or more red bas). Looks to me, usually after a few blue bars rebound there’d be a few more red bars down, then, if lucky enough, a sizeable rebound would kick in, but if not lucky then there’d be the 3rd leg down.

So my conclusion is that bulls need some lucks tomorrow. Hopefully:

- The both VIX and SPX red trick (see chart 6.2.4a SPX and VIX Divergence Watch) mentioned in today’s After Bell Quick Summary could work.

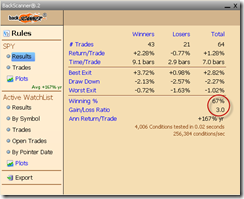

- The Reversal Bar setup could work which had 67% winning rate if it could be confirmed tomorrow.

0.0.2 Combined Intermediate-term Trading Signals, I mentioned this chart yesterday, 3 points validated trend line was broken which argues that the market may have topped.