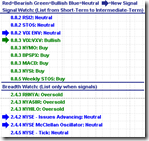

Today all short-term overbought signals have been corrected. Look at the following chart, 0.0.0 Signal Watch and Daily Highlights, all short-term signals are neutral while the mid-term signals are still bullish. However, it seems not so good should the market dips further, especially if SPX tests Oct 10th low. Usually at the third time of testing low, the probability of holding is quite low, then the mid-term bullish signals are in danger of reversing. Therefore it is not wise to buy dip blindly and better to be cautious.

1.0.3 S&P 500 SPDRs (SPY 60 min), 1.1.5 PowerShares QQQ Trust (QQQQ 60 min), 1.2.3 Diamonds (DIA 60 min). The selling off is right at Fib 61.8, and RSI is right at oversold level but no positive divergence yet. Therefore tomorrow morning the selling off might possibly continue.

1.0.4 S&P 500 SPDRs (SPY 15 min), 1.1.6 PowerShares QQQ Trust (QQQQ 15 min), 1.2.4 Diamonds (DIA 15 min). MACD and RSI look a bit positive divergence but far from enough, which means the plummet might continue.

1.0.5 Major Accumulation/Distribution Days. Today is the second major distribution day. As you know, the market may rally significantly after two or three major distribution days. So at least we have a hope although we don't know if the third major distribution day will appear.

3.2.0 CurrencyShares Japanese Yen Trust (FXY Daily). The bullish morning star on Yen has been confirmed today, and this is bearish to the stock market.

2.8.0 CBOE Options Equity Put/Call Ratio. According to the patterns in the past, I don't know if it means the descending trend is broken and the market is going back to the down trend. If this is true, the situation will be very bad and the Oct 10th low of SPX will very possibly lose. I am not completely sure about the chart (or I am not willing to believe in it), just for your information only.

Hi Cobra,

ReplyDeleteAs a regular reader of your blogs & other professionals, I'd say that yours are the best that I have seen.

Even though my methods and yours to analyze market are quite different, our conclusions are quite similar. However, I always check out your blogs to confirm my point of views. I believe you do possess deep knowledge of a Technical Analysis expert.

Like other readers on your blogs, I believe that we own you an appreciation of your hard-working posts.

Thank you,

Tom

Thank you, Tom!

ReplyDelete