Short-term the market is overbought, but I'm not sure if it will pullback tomorrow as most traders are away. As per 12/30 report, in order to prove that the up strength is stronger, tomorrow the market has to be up. Intermediate-term, some topping signals I see, so if luckily tomorrow the market goes up again, it might be a good idea to reduce the intermediate-term positions.

Short-term overbought signals:

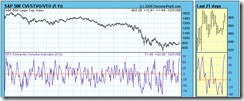

0.0.2 SPY Short-term Trading Signals, where NYADV and NYMO are very reliable signals.

1.0.3 S&P 500 SPDRs (SPY 30 min), overbought plus possible sell signals if further down tomorrow.

1.0.4 S&P 500 SPDRs (SPY 15 min), lots of negative divergence.

T2122 from Telechart, 4 week New High/Low Ratio, high enough for me to justify a pullback although it still can up a little more.

SPX Climactic Volume Indicator from Decision Point, multi-year high to me.

About intermediate-term warnings, I'm not saying that the market has topped as we had only 26 trading days so far till now, while even the failed bounce in August 2008 had 32 trading days. Why are trading days important? Because the big money cannot move as fast as we retailers.

T2101 from Telechart which is simply the absolute value of the number of advancing issues minus the number of declining issues. Well, forget about the definition of the T2122, just look at 10 day moving averages of this chart and compare it with the blue curve representing SPX. What do you see? Every time the moving average turns so does the SPX, right? Well, the moving average is about to turn now...

2.0.1 Volatility Index (Weekly), pay attention to red dashed lines, whenever RSI and STO reaches certain low point, the SPX reaches the top, which is represented by green curves. Well, sure, we're not there yet, but it's about the time we pay close attention, right?

0.0.1 Market Top/Bottomed Watch, again, not there yet, but be aware.

the market looks like its massively overbought. Short term tick is at levels ive never seen

ReplyDelete