Summary:

US$ could rebound.

| TREND | MOMENTUM | EMOTION | COMMENT - Sample for using the trend table. | |

| Long-term | Up | Disbelieve | ||

| Intermediate | Down | Neutral | ||

| Short-term | Up | Neutral | ||

| SPY SETUP | ENTRY DATE | INSTRUCTION | STOP LOSS | Mechanic trading signals for reference only. Back tested since 2002. |

| ST Model | 11/17 L | *Adjust Stop Loss | *11/13 Low |

|

| Reversal Bar |

| |||

| NYMO Sell |

| |||

| VIX ENV | ||||

| Patterns ect. |

INTERMEDIATE-TERM: EXPECT CONSOLIDATION THEN PULLBACK

Another consolidation day today so the direction is unclear. Still maintain the forecast of “consolidaton then pullback”.

1.0.4 S&P 500 SPDRs (SPY 15 min), a Symmetrical Triangle was formed, because a Symmetrical Triangle usually means wave 4, so most wave analysts I see, are expecting an up day tomorrow for the final wave 5 up. For this, I just have one thing to remind you, 1.0.2 S&P 500 SPDRs (SPY 60 min), a gap up open tomorrow will be the SPY’s 14th gap.

Nothing else to say, if indeed we have an up day tomorrow, I suspect how high it could go. Reasons:

6.4.5 GLD and UUP Watch, GLD black bar means UUP high open and most likely closes in green. This is not good for the stock market.

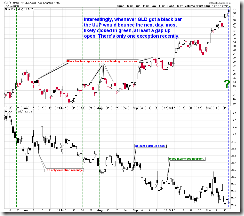

3.1.0 PowerShares DB US Dollar Index Bullish Fund (UUP Daily), hollow red bar plus ChiOsc way too low also mean that UUP could rebound at least for a few days.

3.4.1 United States Oil Fund, LP (USO Daily), black bar means that oil could pullback which is not good for the stock market too.

SHORT-TERM: NO UPDATE

INTERESTING CHARTS: NONE