| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

|

SHORT-TERM: EXPECT PULLBACK SOON

Still expect a short-term pullback at least. I’ve mentioned enough reasons in 09/09 Market Recap and the Friday’s After Bell Quick Summary:

- Pivot window around 09/07 to 09/10.

- 6.4.6a QQQQ Black Bar Watch, QQQQ black bar.

- 0.2.2 Extreme Put Call Ratio Watch, CPCI too high.

- 0.2.5 NYSE Total Volume, NYSE total volume too low.

- 1.0.0 S&P 500 SPDRs (SPY 60 min), Bearish Rising Wedge as ending pattern plus RSI negative divergence.

- 1.0.6 SPY Unfilled Gaps, 16 unfilled gap, too many.

- 6.4.4 SPY Price Volume Negative Divergence Watch, price volume negative divergence.

I’m not sure if we’ll see one more push up on next Monday though, because 1.0.1 S&P 500 SPDRs (SPY 15 min), looks like an Ascending Triangle in the forming therefore it could have one more push.

Besides, if Monday gap down unfilled then we’ll have another back to back unfilled gap which is supposed to be filled very soon. So again whether the market starts to pullback on Monday, I have some doubts.

Nothing else new to say. There’re 2 updates on the above mentioned top signals, take a look below if interested, they simply make the top of some kind look more real.

0.2.5 NYSE Total Volume, much lower, no good.

0.2.2 Extreme Put Call Ratio Watch, CPCI skyrocketed high again, no good too.

INTERMEDIATE-TERM: TO BE ASSESSED, IT’S NOT AS BULLISH AS I ORIGINALLY THOUGHT

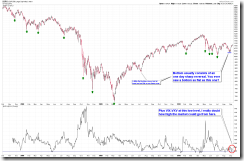

About the intermediate-term, see chart below, the market is not as strong as I originally thought. At least it’s not repeating what happened in March and July 2009, instead in terms of strength, it looks a lot like an usual 2 weeks in a row rebound we saw in the past, especially if the market does pullback hard the next week. So, I temporarily hold the forecast of expecting 3 legs up, mini 100 SPX point up from 08/27 close mentioned in 09/03 Market Recap. I need more evidences to assess the intermediate-term trend.

About whether 08/27 is the bottom, in 09/03 Market Recap, I mentioned that VIX:VXV is too low therefore I really doubt how far the market could go. Actually, there’s another suspect, see chart below, seldom a bottom is flat, so if 08/27 is the bottom, then this bottom must be very very unique. Anyway, I’ll put these 2 guys into suspect list, will combine all the other factors I see the next week together to assess the intermediate-term trend.

SEASONALITY: SEPTEMBER IS BEARISH, THE TRIPLE WITCHING FRIDAY IS BULLISH

See 09/03 Market Recap for September seasonality.

Also according to Stock Trader’s Almanac, the September Triple Witching, Dow up 5 straight and 6 of last 7.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

| TREND | DTFMS | COMMENT – *New update. Click BLUE to see chart if link is not provided. | |

| QQQQ | UP | *4.1.1 Nasdaq 100 Index (Weekly): NDX to SPX ratio too high. | |

| IWM | *UP | *2 black bars in a row, pullback? | |

| CHINA | UP | Head and Shoulders Bottom in the forming? | |

| EMERGING | UP | 4.1.6 iShares MSCI Emerging Markets (EEM Weekly): EEM to SPX ratio too high. | |

| EUROPEAN | UP | *BUY | *2 reversal like bars in a row, doesn’t look good. |

| CANADA | *UP | *TOADV MA(10) too high, may pullback further. | |

| BOND | DOWN | *SELL | 4.2.0 20 Year Treasury Bond Fund iShares (TLT Weekly): Too far away from MA(200). *3.0.0 20 Year Treasury Bond Fund iShares (TLT Daily): pullback to trend line support, rebound? |

| EURO | *LA | ||

| GOLD | DOWN | SELL | |

| GDX | DOWN | SELL | *4.3.1 Market Vectors Gold Miners (GDX Weekly): GDX to SPX ratio too high and Bearish Engulfing. |

| OIL | *UP | *BUY | |

| ENERGY | *UP | *BUY | |

| FINANCIALS | UP | 4.4.2 Financials Select Sector SPDR (XLF Weekly): Head and Shoulders Top in the forming? *3.4.0 Financials Select Sector SPDR (XLF Daily): 2 reversal like bars, doesn’t look good. | |

| REITS | *LA | 4.4.3 Real Estate iShares (IYR Weekly): Home builder is lagging and IYR to SPX ratio too high. | |

| MATERIALS | *UP |

*LA = Lateral Trend.