| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

|

SHORT-TERM: HIGHER HIGH THEN PULLBACK

Why there’ll be higher high first?

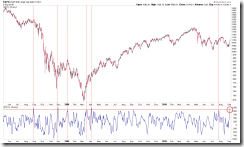

Friday is a Major Accumulation Day (NYSE Up Volume : NYSE Down Volume >= 9) which almost guarantees an immediate higher high.

Generally, a RSI negative divergence is required on SPY 60 min chart before the pullback. I don’t see such a negative divergence yet.

1.0.6 SPY Unfilled Gaps, a gap down open the next Tuesdays is guaranteed to be filled within days, as back to back unfilled gaps are rare, at least not seen from the chart below.

The chart below explains why if the Tuesday gap down is unfilled, it’s a back to back unfilled gap.

Why there’ll be a pullback after a higher high?

I mentioned TICK MA(3) too high in 09/02 Market Recap. On Friday, it went even higher.

T2122, too high. This is my ultimate weapon for watching overbought/oversold.

6.2.3 VIX:VXV Trading Signals, too low. This chart, by the way, is bear’s biggest hope as theoretically the market couldn’t go far if VIX:VXV is too low. However, since the market has been showing very strong up momentum recently, I must respect the general rule first – a forward accelerating car has to slow down first before it can be reversed, so let’s just keep in mind that we have a suspect (VIX:VXV too low) here, but we need gather more evidences to prove its guilt.

6.2.2a VIX Trading Signals (BB), VIX closed below BB is a potential short setup. I’ve discussed this setup in 04/13 Market Recap. When SPY ST Model was in sell mode (see table above, as of now), its winning rate was 100%, however it has only 5 cases which are too few to read into seriously.

The last but not the least, don’t forget the pivot date from 09/07 to 09/10 I mentioned in 08/27 Market Recap. They now look like a top. Personally, I think they probably mean a short-term top, not as important as I originally thought when I mentioned them at the first place.

INTERMEDIATE-TERM: EXPECT 3 LEG UP, MINI SPX 100 POINT FROM 08/27 CLOSE

As for the conclusion of 3 leg up and 100 SPX up points, it’s more likely a general rule or my experiences: A strong up momentum like we’re having now won’t just have one leg, mini mini it should be two legs up. Since the conclusion is very difficult to back test, so the arguments given below are little bit speculative. For more details (and perhaps more solid proofs) we’ll have to wait and see.

The chart below shows what happened after 2 legs down recently. Looks to me the rebound thereafter guarantees that 08/09 high at 1129 will be taken.

From the chart below we can see, the pullback becomes weaker and weaker while the rebound gets stronger and stronger, from 29 to 39 to 100, so it’s quite logical to assume the rebound since 08/27 should be no less than 100 points. The rebound time could be 31 trading days (The 1st rebound lasted 5 trading days, the 2nd rebound lasted 18 trading days and the 3rd rebound lasted 26 trading days, so 18 – 5 = 13, 26 – 18 = 8, the previous prime number before 13 and 8 is 5, so 26 + 5 = 31. If you don’t understand what I’m saying, doesn’t matter, it’s just for fun.) which ends around 10/11 and which coincidently is perhaps one of the most important date in history as 10/11/2007 is the all time high. Merely coincidence? Well, we’ll see.

The chart below should enough explain the Island Reversal pattern mentioned in the chart above.

SEASONALITY: DAY AFTER LABOR DAY WAS BULLISH, THE WHOLE SEPTEMBER IS BEARISHAccording to Stock Trader’s Almanac, day after labor day Dow up 12 of last 15.

The following chart is from Bespoke:

The following chart is from sentimentrader:

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

*I’ve changed the trend indicator, now it should respond much faster.

| TREND | DTFMS | COMMENT – *New update. Click BLUE to see chart if link is not provided. | |

| QQQQ | UP | ||

| IWM | UP | ||

| CHINA | UP | Head and Shoulders Bottom in the forming? | |

| EMERGING | UP | 4.1.6 iShares MSCI Emerging Markets (EEM Weekly): EEM to SPX ratio too high. | |

| EUROPEAN | UP | ||

| CANADA | UP | *Black bar, pullback? | |

| BOND | DOWN | SELL | 4.2.0 20 Year Treasury Bond Fund iShares (TLT Weekly): Too far away from MA(200). *Hollow red bar, rebound? |

| EURO | UP | ||

| GOLD | LA | ||

| GDX | UP | 4.3.1 Market Vectors Gold Miners (GDX Weekly): GDX to SPX ratio too high, pullback? | |

| OIL | UP | *BUY | 4.4.0 United States Oil Fund, LP (USO Weekly): USO to SPX ratio too low, rebound? |

| ENERGY | UP | ||

| FINANCIALS | UP | 4.4.2 Financials Select Sector SPDR (XLF Weekly): Head and Shoulders Top in the forming? | |

| REITS | UP | 4.4.3 Real Estate iShares (IYR Weekly): Home builder is lagging and IYR to SPX ratio too high. | |

| MATERIALS | UP |

*LA = Lateral Trend.