| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

|

SHORT-TERM: STILL EXPECT PULLBACK, NOT SURE WHEN AS THE MARKET MAY STILL HAVE A FEW DAYS UP

Maintain the forecast mentioned in 09/13 Market Recap: Expect a pullback, but it may occur after a few days small up or consolidation.

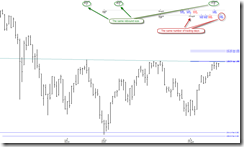

The chart below so far fits for a few days of consolidation pattern I’ve been blah blah. Just a reminder: A breakout of a consolidation range could be on either side, so although it now looks a lot like a repeat of the August top but I cannot exclude the possibility of an upside breakout, so strictly speaking the short-term direction is not clear.

1.0.1 S&P 500 SPDRs (SPY 15 min), could be an Ascending Triangle in the forming plus seemingly very good responses toward RIMM and ORCL ER in AH, so maybe we’ll see the much waited huge up day tomorrow. If so, be careful bears, as a renewed up momentum usually won’t be just an one day wonder.

I’ve illustrated the chart below in 09/14 Market Recap. Tomorrow is another Fib 100% retracement in terms of trading days, so equally, I cannot exclude the possibility that tomorrow will be a top of some kind. No matter a top or huge up day tomorrow, the next pivot date will be in 09/21 to 09/23 time window which I’ll explain in the weekend report.

INTERMEDIATE-TERM: BULLISH, BUT HOW BULLISH IS TO BE REASSESSED

See 09/10 Market Recap for more details.

SEASONALITY: SEPTEMBER IS BEARISH, THE TRIPLE WITCHING FRIDAY IS BULLISH

See 09/03 Market Recap for September seasonality.

Also according to Stock Trader’s Almanac, the September Triple Witching, Dow up 5 straight and 6 of last 7.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

| TREND | COMMENT – *New update. Click BLUE to see chart if link is not provided. | |

| QQQQ | UP | 4.1.1 Nasdaq 100 Index (Weekly): NDX to SPX ratio too high. |

| IWM | *LA | |

| CHINA | Head and Shoulders Bottom in the forming? | |

| EMERGING | *LA | 4.1.6 iShares MSCI Emerging Markets (EEM Weekly): EEM to SPX ratio too high. *1.4.1 iShares MSCI Emerging Markets (EEM Daily): Hollow red bar again, looks toppy. |

| EUROPEAN | UP | Hollow red bar, pullback? |

| CANADA | LA | TOADV MA(10) too high. Hanging Man and Shooting Star and Hanging Man again, more pullback? |

| BOND | DOWN | *Breakdown below an important support. |

| EURO | UP | *Black bar, pullback? |

| GOLD | UP | |

| GDX | *UP | 4.3.1 Market Vectors Gold Miners (GDX Weekly): GDX to SPX ratio too high and Bearish Engulfing. |

| OIL | *DOWN | |

| ENERGY | LA | 2 Doji in a row, doesn’t look good. |

| FINANCIALS | *LA | 4.4.2 Financials Select Sector SPDR (XLF Weekly): Head and Shoulders Top in the forming? |

| REITS | *LA | 4.4.3 Real Estate iShares (IYR Weekly): Home builder is lagging and IYR to SPX ratio too high. 3.4.1 Real Estate iShares (IYR Daily): Hollow red bar, pullback? |

| MATERIALS | UP | 2 hollow red bars in a row, pullback? |