| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

|

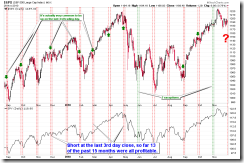

SHORT-TERM: DIRECTION NOT CLEAR, MARKET MAY BE RANGE BOUNDED

The market stuck in a range so the direction is not clear. Better we wait for the breakout before taking further actions. Trading is like fishing, more often than not, patience is the key. Not much to say, but promise is promise so I squeezed 3 points here:

- Chances are little bit better the market may continue on the downside.

- The market may stay in the current range for a few more days.

- The next possible pivot time window is from 12/03 to 12/06, not sure it means top or bottom.

Why chances a little bit better the market may continue down?

- Because could be a Symmetrical Triangle in the forming, which theoretically means a continuation so chances are little bit better the market may continue on the downside.

- Seasonality is generally bearish the next week (see seasonality session below).

Why the market may stay in the current range for a few more days?

1.0.6 SPY Unfilled Gaps, SPY has 4 unfilled gaps above and 21 unfilled gaps below, from my observation, bears seemed hardly to hold the 5th down gap, while bulls seemed unable to hold the 21st gap. So either gap up or down the next Monday, the gap would get filled very quickly and perhaps more gaps along the way would be filled before the market is able to sustain on one direction.

Why the next possible pivot time window is from 12/03 to 12/06?

- Non Farm Payroll is on 12/03. As you all know now that Non Farm Payroll day was very likely a pivot date, especially if it’s a red day.

- Multiple Gann Day due on 12/02 to 12/05.

- Magic Day 6.

- According to the 3rd party document, 12/02 could be the most possible pivot date in December.

The latest Institutional Buying and Selling Actions from StockTiming (up to 11/24) as requested.

INTERMEDIATE-TERM: 2 MAJOR DISTRIBUTION DAYS WITIN 5 DAYS MEANS MORE PULLBACKS AHEAD

The intermediate-term is in danger of entering a downtrend. See 11/23 Market Recap for more details.

SEASONALITY: MONDAY AND TUESDAY BEARISH, WEDNESDAY (12/01) BULLISH, WHOLE WEEK BEARISH

According to Stock Trader’s Almanac (2011):

- Monday after Thanksgiving week, Dow down 5 straight 2004 – 2009.

- First Trading Day in December, NASDAQ up 17 of 23, Down three straight 2006 – 2008.

According to Cobra’s Market View (LOL):

6.5.2b Month Day Seasonality Watch, the last 2 trading days of every month since August 2009 were bearish.

6.5.2c Week Seasonality Watch, the last trading week of every month since August 2009 was generally bearish.

For November seasonality chart please refer to 11/11 Market Recap for more details.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

| SIGNAL | COMMENT | |

| QQQQ | 11/16 S | |

| NDX Weekly | UP | NASI STO(5,3,3) sell signal. |

| IWM | ||

| IWM Weekly | UP | *IWM:SPX too high. |

| CHINA | ||

| CHINA Weekly | UP | |

| EEM | ||

| EEM Weekly | UP | |

| XIU.TO | 11/16 S | |

| XIU.TO Weekly | UP | |

| TLT | ||

| TLT Weekly | DOWN | |

| FXE | ||

| FXE Weekly | *DOWN | |

| GLD | ||

| GLD Weekly | UP | |

| GDX | 11/16 S | |

| GDX Weekly | UP | |

| USO | ||

| WTIC Weekly | UP | |

| XLE | 06/15 L | |

| XLE Weekly | UP | |

| XLF | 10/15 L | |

| XLF Weekly | UP | |

| IYR | ||

| IYR Weekly | UP | Home builders are lagging. |

| XLB | 11/16 S | |

| XLB Weekly | UP |

- Please make sure you understand how to use the table above. The purpose of this report is to provide info so contradictory signals are always presented.

- Position reported in short-term session of the table above is for short-term model only, I may or may not hold other positions which will not be disclosed.

- Conclusions can be confirmed endlessly, but trading wise, you have to take actions at certain risk level as soon as you feel the confirmation is enough. There’s no way for me to adapt to different risk levels therefore no trading signals will be given in this report except the mechanical signals such as SPY ST Model.

- * = New update; Blue Text = Link to a chart in my public chart list.

- Trading signals in OTHER ETFs table are mechanical signals. See HERE for back test results. 08/31 L, for example, means Long on 08/31.

- UP = Intermediate-term uptrend. Set when I see at least one higher high and higher low on weekly chart.

- DOWN = Intermediate-term downtrend. Set when I see at least one lower high and lower low on weekly chart.