| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

|

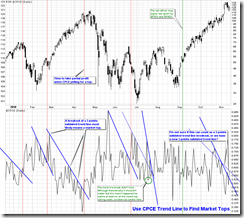

SHORT-TERM: MORE TOP SIGNS

I see one top sign and 2 suspicious top signs today, so maybe, probably, possibly, at least short-term, we could see more pullbacks and therefore the 2.5%+ pullback (ZigZag 2.5%+) mentioned in 11/08 Market Recap is still possible. My guess is that most of you would find very hard to believe this, judging from the sharp drop in visits from both my forum and this blog recently and judging from the AAII chart below. Well, let’s see.

Begin with tomorrow first, I mentioned one bearish reason from tomorrow in today’s After Bell Quick Summary, well, here is another one: The ChiOsc is a little high, plus trend line as well as MA resistances so at least we could see some weakness tomorrow morning.

Now, let’s talk about the top sign and the suspicious top signs added today. I’ve been mentioning some other top signs recently, I suggest you to review the table above one more time because these signs gradually weight more and more.

0.2.4 Nasdaq Total Volume/NYSE Total Volume, this is the most important chart of today, see dashed red line (so you don’t need know why this chart should work), what happened thereafter when NATV:NYTV was too high?

0.0.2 Combined Intermediate-term Trading Signals, this is a suspicious top sign because I’m not sure whether we’ve had an valid trend line and whether today we had an valid breakout. Well, whatever, if this chart keeps rising tomorrow, then better be careful because today’s ambiguity would be gone.

The TED negative divergence reflects well the recent pullback reasons: All about the European sovereign debt crisis. Let’s see whether the 28 trading days are merely coincidences or not.

INTERMEDIATE-TERM: SPX MAY SHOOT HIGH THEN FALL BACK TO WHERE IT STARTS WHICH USUALLY IS THE 2ND BUY OPPORTUNITY

See 11/05 Market Recap for more details.

SEASONALITY: LAST 2 MONTHS OF YEAR ARE BULLISH

See 10/29 Market Recap for more details. Also below is the November seasonality chart from Sentimentrader, as requested.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

| SIGNAL | COMMENT | |

| QQQQ | 10/15 L | |

| NDX Weekly | UP | %B too high with negative divergence. NASI STO(5,3,3) sell signal. NDX:SPX too high. Too far away from MA(200) (PPO(1,40,1) too high). |

| IWM | ||

| IWM Weekly | UP | |

| CHINA | 07/15 L | |

| CHINA Weekly | UP | |

| EEM | ChiOsc is too high. | |

| EEM Weekly | UP | EEM:SPX too high. |

| XIU.TO | 08/31 L | TOADV MA(10) too high. |

| XIU.TO Weekly | UP | |

| TLT | ChiOsc is too low. | |

| TLT Weekly | DOWN | |

| FXE | ||

| FXE Weekly | UP | |

| GLD | ||

| GLD Weekly | UP | |

| GDX | 10/29 L | |

| GDX Weekly | UP | BPGDM too high, pullback? |

| USO | WTIC breakout! | |

| WTIC Weekly | UP | |

| XLE | 06/15 L | |

| XLE Weekly | UP | |

| XLF | 10/15 L | Complex Head and Shoulders Bottom or Double Bottom breakout, target $16.74. |

| XLF Weekly | UP | |

| IYR | ||

| IYR Weekly | UP | Home builders are lagging. |

| XLB | 11/02 L | |

| XLB Weekly | UP | BPMATE overbought. XLB:SPX a little too high. |

- Please make sure you understand how to use the table above. The purpose of this report is to provide info so contradictory signals are always presented.

- Position reported in short-term session of the table above is for short-term model only, I may or may not hold other positions which will not be disclosed.

- Conclusions can be confirmed endlessly, but trading wise, you have to take actions at certain risk level as soon as you feel the confirmation is enough. There’s no way for me to adapt to different risk levels therefore no trading signals will be given in this report except the mechanical signals such as SPY ST Model.

- * = New update; Blue Text = Link to a chart in my public chart list.

- Trading signals in OTHER ETFs table are mechanical signals. See HERE for back test results. 08/31 L, for example, means Long on 08/31.

- UP = Intermediate-term uptrend. Set when I see at least one higher high and higher low on weekly chart.

- DOWN = Intermediate-term downtrend. Set when I see at least one lower high and lower low on weekly chart.