The bottom line, the short-term trend is down. I hold both long and short overnight.

As mentioned in the intraday comment, I don’t feel good about tomorrow at least in the morning, but the setups I have to report are pretty bullish going forward. Again, this report has nothing to do with what I really believe, but past patterns and statistics, so make your own decisions wisely.

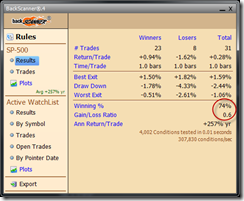

As mentioned in the last night report, SPX down 4 days in a row, buy at close then sell tomorrow at close, you’ll have 74% chances since year 2003.

A few TradingMarkets setups have been triggered again, all claimed to have above 80% winning rate. I personally didn’t verify their claims though.

Demo account for short-term model, $200 max loss allowed per trade. Mechanical trading signal, for fun only.

| TICKER | Entry Date | Entry Price | Share | Stop Loss | Exit Date | Exit Price | Profit | Comment |

| SDS | 04/12/2011 | $21.30 | 200 | $20.45 | New strategy, always hold. | |||

| SSO | 04/11/2011 | $53.16 | 100 | $51.57 | Not sure, speculation play. | |||

| SDS | 04/11/2011 | $20.93 | 200 | $20.45 | 04/12/2011 | $21.34 | 82.00 | |

| SSO | 04/08/2011 | $53.47 | 100 | $51.57 | 04/11/2011 | $53.58 | 11.00 | |

| SDS | 04/07/2011 | $20.71 | 400 | $20.46 | 04/08/2011 | $20.86 | 60.00 | Against trend 1st time, half positioned. |

| SSO | 04/07/2011 | $54.35 | 100 | $53.09 | 04/08/2011 | $54.36 | 1.00 | |

| SSO | 04/06/2011 | $53.93 | 200 | $53.09 | 04/06/2011 | $54.13 | 40.00 | |

| SSO | 04/04/2011 | $53.74 | 100 | $53.09 | 04/08/2011 | $54.00 | 26.00 | |

| SSO | 04/01/2011 | $54.00 | 100 | $51.57 | 04/05/2011 | $54.18 | 18.00 | |

| SSO | 03/28/2011 | $52.02 | 100 | $49.91 | 04/01/2011 | $54.09 | 207.00 | |

| LAST | 1158.00 | |||||||

| SUM | 1603.00 |